December 2024 Logistics Managers’ Index

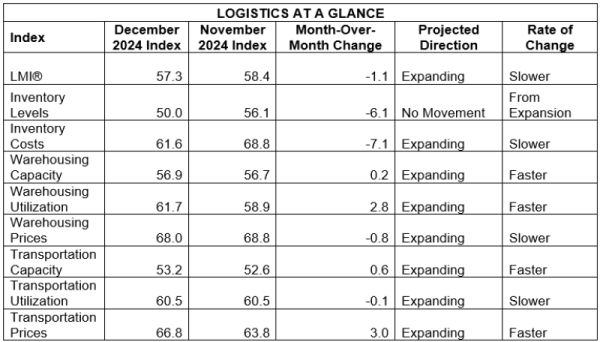

The December 2024 Logistics Managers’ Index. The December Logistics Manager’s Index reads in at 57.3, down (-1.1) from November’s reading of 58.4. This slowdown in logistics activity is due to the seasonal wind-down in Inventory Levels, which dropped (-6.1) to 50.0 or “no change”. The no change designation does not tell the entire story. Inventory Levels actually increased, reading in at 57.9, for Upstream firms like manufacturers, wholesalers, and 3PLs that are on the receiving end of the surge of imports that have been coming into the U.S. through December. Conversely, Downstream retailers are reporting significant contractions in Inventory Levels at 33.9; which is what should be happening in December during the holiday shopping season. The reduction in Inventory Levels also led to a drop in the rate of growth for Warehousing Capacity (-7.1) to 61.6. Interestingly, Transportation Prices are up (+3.0) to 66.8 which is the fastest rate of expansion for this metric since April of 2022. This also puts Transportation Prices above the all-time average of 65.0 for this metric for the first time in over 2.5 years. This is likely a function of the strong consumer sales we have seen throughout the second half of 2024. There has been higher demand for transportation services to move goods, this was particularly pronounced in December due to the record levels ecommerce requiring expensive last-mile delivery.

The other five metrics, including all three warehousing metrics, were steadier from November to December. Warehousing continues its strong run, with Warehousing Utilization (+2.8) and Warehousing Prices (-0.8) coming reading in at 61.7 and 68.0 respectively, signaling strong rates of expansion.

Researchers at Arizona State University, Colorado State University, Florida Atlantic University, Rutgers University, and the University of Nevada, Reno, and in conjunction with the Council of Supply Chain Management Professionals (CSCMP) issued this report today.

The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in November 2024.

The LMI read in at 57.3 in December, down (-1.1) from November’s reading of 58.4. As discussed above, this was largely due to seasonal drawdowns in Inventory Levels, and the associated costs of holding them, at the retail level. The difference in the overall index for Downstream retailers and their Upstream counterparts was quite pronounced in December, with Downstream firms registering only very mild contraction at 51.9 compared to the statistically significantly more robust expansion of 60.3 for Upstream firms. This is the reverse of the dynamic we observed in October when it was Downstream firms reporting more logistics activity in an attempt to get things in place for the holiday season.

Retailers were clearly correct in their bet to stock on goods ahead of the holiday season. Holiday sales from November until Christmas Eve were up 3.8% year-over-year according to Mastercard. This was largely driven by a 6.7% increase in ecommerce sales, although in-person spending was up 2.9% as well. The increase in spending came despite the shorter holiday season due to the late Thanksgiving. The NRF estimates that U.S. shoppers spent just short of a trillion dollars in November and December, making it the busiest holiday season of all time[1]. It was also a happy holiday season for investors. The S&P 500 ended 2024 up 23% on the year. This is the second consecutive year the index has been up over 20% annually. Much of this was due to rate cuts, the winddown of inflation, consumer spending, and enthusiasm around AI[2]. This is a continuation of the trend we have seen all year. The strength of the U.S. economy relative to the rest of the world has led to the dollar being much stronger than other currencies around the world. The dollar may become even stronger given recent comments by the Fed on needing to wait and see ahead of further cuts to the interest rate. This trend significantly benefits U.S. importers, but does make exports slower[3]. Some of these concerns may be reflected in the marginally statistically significant differences in future predictions for respondents. Upstream firms continue to predict slightly more robust rates of growth at 67.8, than their Downstream counterparts who are predicting slightly slower (although still strong growth at 62.0.

Despite all the good news, inflation continues to be tricky. The U.S. personal consumption expenditures (PCE) index was up 2.4% in November, which is slightly above the Fed’s target of 2%. While this is nowhere near the staggering rates of inflation from 2022, the stickiness of price increases is likely a major contributor (along with strong consumer spending) to the Fed’s prediction that they would only consider cutting rates twice in 2025[4]. Those issues pale in comparison to the economic conditions abroad. The U.K. economy has stagnated as inflation jumped back up in late 2024. Germany, France, and Canada’s governments will all be dealing with elections as economic conditions in those countries have made their governing coalitions deeply unpopular[5].

The mid-December import spike is partially explained by firms attempting to avoid incoming tariffs. A survey by GEP and S&P Market Intelligence shows that buying activity by North American Manufacturers hit its highest level in over a year. Due to the uncertainty of when tariffs might happen or how large they may be, many of these manufacturers are focused on critical items, and are taking a “wait and see approach” for everything else[6]. Although overall Inventory Levels are down (-6.1) to “no change” at 50.0, Upstream and Downstream firms reported totally different numbers. Upstream firms saw growth at 57.9, as evidenced by Indian and Chinese manufacturers increasing their orders of raw materials in November in anticipation of an increase in orders from U.S. customers. There is evidence that this strategy has paid off, as orders have increased as U.S. manufacturers began increasing their stockpiles of goods and components in late 2024[7]. Conversely, Downstream firms reported a steep contraction in Inventory Levels at 33.9, consistent with reports of strong holiday sales for retailers. Interestingly, both Upstream and Downstream retailers are predicting that Inventory Levels will increase significantly over the next 12 months with future predicted expansions of 71.7 and 69.4 respectively. These numbers both represent significant rates of expansion and would be a major departure for the leaner inventory policies that categorized 2023 and 2024. By bringing inventories forward now, retailers hope to avoid increasing costs stemming from potential tariffs on consumers already tired from the inflation of 2021-2022[8]. Costs remain an issue as Inventory Costs, while down by 7.1 points, are still increasing at 61.6 which is a solid rate of growth. This is driven more by Upstream (65.7) than Downstream (54.8) firms. It is also notable that Inventory Costs were 9.8 points higher in the second half of the month, bumping up from 56.9 in early December to 66.7 in the second half of the month.

The high levels of activity will not be a major departure for the ports. The Port of Long Beach processed 9.6 million TEUs in 2024, breaking the previous record set in 2021. This was up approximately 20% year-over-year[9], highlighting the difference between consumer behavior and corporate inventory strategies from 2023 to 2024. This fall has seen a similar story at the Port of Oakland where imports were up 13.1%, and exports up 8.5%, in November from the year prior[10]. This looks to continue into 2025. TEUs are up approximately 70% in the first full week of January[11]. This comes after several weeks of imports being up over 50% year-over-year to close out December. The difference seems to be that whereas in 2024 goods were coming in quickly but also being sold quickly in a reflection of JIT strategies, some of the projected buildup in 2025 seems to be in anticipation of stockpiling goods to be sold later.

Labor disputes could present a challenge for this anticipated inventory buildup. Negotiations between the ILA and East Coast ports are set to resume on January 7th[12]. President-elect Trump has voiced his support for the ILA in these talks, coming out against increasing automation at the docks[13]. The Ports of New York and New Jersey are also engaging in separate negotiations with terminal operators in an attempt to get a larger cut of the revenue generated by the increasing volume of goods passing through East Coast ports. The New York and New Jersey ports processed 6.6 million containers in the first nine months of 2024, representing an increase of 13.8% year-over-year[14]. What volume of ships will be flowing to either coast via the Suez Canal in 2025 remains an open question. The issues in the Red Sea have caused revenues at the Suez Canal to drop by 60% in 2024. Canal authorities are attempting to dredge deeper in an effort to facilitate two-way traffic. Initial testing has been successful. This would allow the canal to have throughput and also make is less susceptible to disruptions like it experienced in 2021[15].

Perhaps reflecting the increased inventories analysts are expecting that available warehousing capacity will tighten up in 2025 relative to 2024 (which some believe was a “low point” of capacity utilization in this cycle) as firms increase inventories through the next 12 months[16]. Warehousing Capacity (+0.2) is at 56.9, which is a mild level of expansion. Growth was much slower for Upstream firms, who reported a score of 53.5 to the Downstream reports of 63.3. Upstream firms are expecting further tightening at 52.1, something that stands in sharp contrast to Downstream firms of Warehousing Capacity expansion at 71.7. This is a continuation of last month’s differences in predicted capacity. It will be interesting to see if this trend holds in January. This is despite estimates by the Industrial Info Resources (IIR) estimates that there is currently $9 billion of warehousing and distribution projects under construction in the U.S. In a move that suggests that e-commerce is continuing to grow, approximately $2 billion of this construction is attributable to Amazon alone[17]. Despite the potential for tariffs between the U.S. and Mexico, logistics service providers (LSPs) such as Prologis and C.H. Robinson are still moving ahead with their significant investments along the U.S.-Mexico border. Mexico has been the U.S.’s largest trade partner since 2019, and LSPs clearly expect that to continue even with potential changes to trade policy[18]. This is consistent with a broader trend of there being more excess logistics capacity than there was during the trade war of 2018-2019. With the extra storage capacity built up during the pandemic, importers have more space to hold goods the high levels of inventory that are currently coming into the U.S. Warehousing Utilization was up (+2.8) to 61.7 (again, driven by more by Upstream firms’ 65.5 than Downstream’s 54.8). We also observe continued growth in Warehousing Prices (-0.8) which read in at 68.0 in December. Price growth was highest in the first half of the month at 72.4, before dropping down to 63.7.

Another challenge to keep an eyer on for warehousing in 2025 is labor. Thousands of Amazon warehouse workers represented by the Teamsters’ Union went on strike during the week before Christmas[19]. While this does not seem to have had a significant impact on package delivery during the holidays, the involvement of Teamsters increases the chances that future strikes and walkouts could occur for at North America’s largest ecommerce retailer. Adding complexity to these talks of unionization is that despite Amazon’s continued push towards automation they are still heavily reliant on human labor. For instance, despite utilizing thousands of robots that perform different tasks, over 2,500 human workers are being brought on at their new Louisiana facility. Despite advances in automation, the human ability to adapt quickly to different types of products in different types of scenarios is still superior to what automation can accomplish, making them a critical piece of the continued growth of e-commerce[20]. Labor is an issue for U.S. manufacturing as well. As more plants have been re- or near-shored manufacturers have faced a shortage of workers, with an average of 100,000 positions for high-skilled manufacturing jobs going unfilled in the last few months[21]. As discussed above, demand for warehousing is expected to increase in 2025, particularly Upstream. It remains to be seen if issues with labor will be a bottleneck on the supply that is available to meet this demand. If so, we may see price growth increase beyond what is being forecasted here.

Transportation Price growth increased (+3.0) to 66.8 in December, which is the fastest rate of growth for this metric since April of 2022. The 13.7-point spread between Transportation Prices and Transportation Capacity is also the highest positive delta in favor of prices since that same month of April 2022. Transportation Capacity is up very slightly (+0.6) to 53.2. Despite the clear growth in freight demand and Transportation Prices, Transportation Capacity still has not dipped into contractionary territory with a reading below 50.0. Available Transportation Capacity has not contracted since July of March of 2022 when the freight recession of 2022-2024 began. This is a testament to the high levels of capacity that were built from 2020-2021. Upstream respondents expect this to change, predicting mild contraction at 48.8 over the next 12 months. Conversely, Downstream respondents expect mild expansion at 53.2. Further evidence of tightening in the freight market can be observed in FreightWaves’ tender rejection index, which briefly went into double digits for the first time in over two years as carriers scrambled to make holiday deliveries in late December[22]. They had been elevated year-over-year even before the holiday rush, so it will be interesting to see how deeply rejection rates sink in January[23]. Transportation Utilization expansion held steady (-0.1) at 60.5. Similar to the dynamic we saw with Warehousing Capacity, Upstream firms predict significantly higher rates of expansion for Transportation Utilization at 72.5 to the more meager Downstream expansion prediction of 56.5.

It will be interesting to see what happens with the costs of transportation going forward. The price of diesel fuel was up very slightly (+$0.027 per gallon) from a week ago, but is still down $0.373 per gallon from this time a year ago, continuing the trend that we observed throughout 2024[24]. It is likely that fuel costs will remain low in 2025 due to the glut in processing capacity brought about by electrification, fracking, and the reemergence of the U.S. as one of the world’s leading energy producers. Crude oil was trading at $73 per barrel at the end of 2024, an affordable number that is artificially inflated by OPEC+ holding back approximately 5 million barrels of production per day in an effort to keep prices high[25]. We also see that the pull forward of inventories has led to an 8% price increase for containers moving from Asia to U.S. West coast in the last week of December[26]. Carriers are expecting trans-Pacific spot rates to increase significantly (with the cost of shipping 40-foot containers estimated to hit $6,000) in January as shippers rush to stay ahead of Chinese New Year[27]. Airfreight is also expected to increase in the same period, particularly for movements from Asia to Europe[28]. It is unclear whether costs will go up or down following the Lunar New Year. Firms are clearly rushing inventories ahead now to get ahead of the holiday and potential tariffs. If tariffs are passed, we might expect to see the market slow down. If tariffs are muted or delayed in their implementation, then inventories may stay leaner and be lower costs, leading to it being moved more frequently which could increase Transportation Prices.

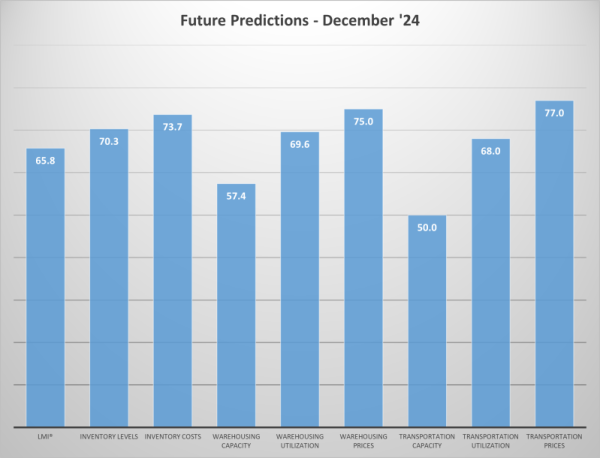

Respondents were asked to predict movement in the overall LMI and individual metrics 12 months from now. Respondents remained optimistic in December, predicting expansion in the overall index at a rate of 65.8, up (+2.2) from November’s future prediction of 63.6. The factors leading to the expansion are notably different in a few places when compared to November’s future predictions. The first of these differences revolve around inventories. Inventory Levels are up (+7.5) to 70.3, which would represent a very significant rate of growth and a sharp turn away from the JIT policies that have characterize the last two years. Relatedly, Warehousing Utilization is expected to increase at a rate of 69.6 (+3.3) and Warehousing Prices are predicted to expand at the robust rate of 75.0 (+1.1) which would be the fastest rate of growth since January 2023 when many firms were still flush with excess inventory. Transportation Prices are expected to increase at a rate of 77.0. This is down (-3.9) from November’s future prediction but would still represent significant rates of expansion. Despite this predicted expansion, Transportation Capacity is expected to hold steady at 50.0, suggesting that there will be enough capacity to soak up demand. It is interesting that firms are now predicting such significant increases in Inventory Levels, it will be critical to keep an eye on these movements in 2025 as inventories are almost always the canary in the coalmine with movements in both the logistics and overall economy.

When comparing feedback from Upstream (blue bars) and Downstream (orange bars) respondents we see a sharp difference from the dynamics that were at play in November. This is most pronounced for Inventory Levels. In November, we saw Downstream retailers build up inventories slightly faster than their Upstream counterparts at a rate of 58.1 to 55.1. In December this shifted dramatically, with Downstream Inventory Levels contracting at a rate of 33.9, which is the most significant rate of decline in any part of the supply chain in more than a year. This shift is dramatic, but it suggests that retailers were able to sell down a large quantity of the goods they had been importing all year, supporting other anecdotal and macro-level evidence of a strong holiday season in 2024. This different extends to the other metrics in expected ways, with Downstream firms reporting significantly lower Inventory costs (54.8 to 65.7), Warehousing Utilization (54.8 to 65.5), and Transportation Utilization (51.7 to 63.8). At the same time, Downstream firms reported marginally significantly higher rates of growth for available Warehousing Capacity (65.5 to 54.8) and Transportation Capacity (63.8 to 51.7). Interestingly, Downstream firms did report slightly higher readings for both price metrics (72.4 to 67.1 for Warehousing and 69.4 to 65.9 for Transportation), which suggests that retailers continued to pay a premium for last mile storage and delivery services. It will be interesting to observe if Downstream respondents snap back towards building inventories again in early 2025, or if this trend continues and they attempt to move back towards leaner policies.

| Inv. Lev. | Inv. Costs | WH Cap. | WH Util. | WH Price | Trans Cap | Trans Util. | Trans Price | LMI | |||||||||||

| Upstream | 57.9 | 65.7 | 53.5 | 65.5 | 67.1 | 51.9 | 63.8 | 65.9 | 60.3 | ||||||||||

| Downstream | 33.9 | 54.8 | 63.3 | 54.8 | 72.4 | 56.7 | 51.7 | 69.4 | 51.9 | ||||||||||

| Delta | 24.0 | 10.8 | 9.8 | 10.7 | 5.3 | 4.8 | 12.1 | 3.5 | 8.4 | ||||||||||

| Significant? | Yes | Marginal | Marginal | Marginal | No | No | Marginal | No | Yes |

Based on future predictions from both Upstream (green bars) and Downstream respondents (purple bars), it seems likely that inventories will rebuild in 2025. Both Upstream and Downstream firms are predicting significant levels of growth for Inventory Levels. Downstream firms are predicting expansion of 69.4 (up from 60.0 in November) and their Upstream counterparts are predicting expansion of 71.7 (up from 64.2 in November). These would represent significant rates of growth, and for Downstream retailers, would be a noted departure from the lean inventory policies they practiced in 2023 and 2024. In a continuation from November, we also see that Downstream firms are predicting more plentiful capacity in 2025. Downstream firms are predicting significantly higher growth than their Upstream counterparts in Warehousing Capacity (71.7 to 52.1), as well as mild growth in Transportation Capacity (53.2) which stands in contrast to predictions of mild contraction (48.8) Upstream. Unsurprisingly given this dynamic, Upstream firms are also predicting significantly higher rates of Transportation Utilization (72.5 to 56.5). Taken all together, these differences lead to a marginally statistically significantly higher rate of growth in the overall metric for Upstream firms (67.8) than for Downstream firms (62.0). The higher rates of Inventory Levels along with decreased use of warehousing and transportation suggests that Downstream retailers are being cautious when it comes to 2025, building up stores of goods and taking a less JIT approach to operations over the next 12 months, potentially responding to concerns over potential tariff increases. Upstream firms on the other hand seem to be moving full speed ahead in 2025, potentially responding to lower interest rates.

| Futures | Inv. Lev. | Inv. Costs | WH Cap. | WH Util. | WH Price | Trans Cap. | Trans Util. | Trans Price | LMI |

| Upstream | 71.7 | 73.8 | 52.1 | 69.7 | 76.1 | 48.8 | 72.5 | 78.0 | 67.8 |

| Downstream | 69.4 | 72.6 | 71.7 | 71.7 | 75.0 | 53.2 | 56.5 | 74.2 | 62.0 |

| Delta | 2.4 | 1.3 | 19.5 | 1.9 | 1.1 | 4.5 | 16.0 | 3.9 | 5.8 |

| Significant? | No | No | Yes | No | No | No | Yes | No | Marginal |

When comparing respondent feedback between early (gold bars) and late (green bars) December, the differences once again come down to inventories. Inventories contracted slightly at 49.0 in early December (12/1-12/15) but began increasing slowly at 51.0 in early December (12/16-12/31). While this difference is small, when taken together with the difference in Upstream and Downstream inventories, as well as the high volume of goods imports in the second half of December, it suggests that as retailers ran inventories down, their Upstream retailers began building them back up. We se evidence of this activity in the marginally higher rates of growth for Inventory Costs (66.7 to 56.9). Interestingly, Warehousing Prices growth slowed (72.4 to 63.7) which may be representative of the more expensive storage facilities used by retailers emptying out over the course of the holiday season. Despite the reports of significant imports in late December, the overall numbers have not moved much, it is only when diving into the differences between Upstream and Downstream firms that the impact of these shifts begins to materialize. It will be important to continue analyzing whether these imports trickle Downstream quickly, or if they remain Upstream in “middle mile” storage facilities.

When interpreting our results, any value about 50.0 indicates growth and any value below indicates contraction. Higher Numbers = More Growth, Lower Numbers = More Contraction. For a more comprehensive discussion of the December 2024 report, access the PDF version of the report here:November 2024 Logistics Managers’ Index. The online version can be accessed here: December 2024 Logistics Managers’ Index Online.

The Logistics Managers Index is a monthly cooperative research venture between several supply chain management universities and CSCMP. We collect data on trends in warehousing, transportation, and inventory across a wide spectrum of industries. If you would like to participate in the January 2024 Reading of this survey click here.

[1] D’Innocenzio, A., & Hadero, H. (2024, December 27). Holiday Shoppers Increased Spending by 3.8%. Transport Topics. https://proxy.qualtrics.com/

[2] Pound, J., & Subin, S. (2024, December 30). S&P 500 posts 23% gain for 2024 as stocks close slightly lower in final session of year. CNBC. https://proxy.qualtrics.com/

[3] Dulaney, C. (2024, December 31). Why the Dollar’s Epic Rally Could Have a Little Further to Run. WSJ. https://proxy.qualtrics.com/

[4] Smialek, J. (2024, December 20). The Fed’s Preferred Inflation Measure Sped Up in November. The New York Times. https://proxy.qualtrics.com/

[5] Nelson, E. (2024, December 19). Britain’s Economy Is ‘Bumbling’ Into the New Year. The New York Times. https://proxy.qualtrics.com/

[6] Berger, P. (2024c, December 13). U.S. Manufacturers Are Stocking Up on Imports Ahead of Tariffs. Wall Street Journal. https://proxy.qualtrics.com/

[7] Supply Chain Xchange Staff. (2024b, December 16). North American manufacturers stockpile goods ahead of Trump term. The Supply Chain Xchange. https://proxy.qualtrics.com/

[8] Ho, J. (2024, December 25). Inventory levels could grow as businesses prepare for Trump tariffs. Marketplace. https://proxy.qualtrics.com/

[9] Chirls, S. (2024a, December 24). Port of Long Beach nears record TEUs. FreightWaves. https://proxy.qualtrics.com/

[10] Chirls, S. (2024b, December 27). Port of Oakland expects return to pre-pandemic cargo volumes. FreightWaves. https://proxy.qualtrics.com/

[11] Port of Los Angeles. (2025, January 5). Port Optimizer—Control Tower. Port of LA Signal – January 5, 2025. https://proxy.qualtrics.com/

[12] Angell, M. (2024, December 31). ILA, USMX contract talks set for Jan. 7 restart ahead of strike deadline: Sources | Journal of Commerce. Journal of Commerce. https://proxy.qualtrics.com/

[13] Berger, P. (2024b, December 13). Trump Expresses Support for U.S. Dockworkers. Wall Street Journal. https://proxy.qualtrics.com/

[14] Berger, P. (2024a, December 1). One U.S. Port Wants a Bigger Payday From Surging Ocean Trade. Wall Street Journal. https://proxy.qualtrics.com/

[15] Chirls, S. (2024c, December 27). Suez toll revenue drops 60%; canal tests two-way traffic. FreightWaves. https://proxy.qualtrics.com/

[16] Cassidy, W. B. (2024, December 30). US warehouse vacancies expected to fall from 2024 ‘peak’ | Journal of Commerce. Journal of Commerce. https://proxy.qualtrics.com/

[17] Supply Chain Xchange Staff. (2024a, December 16). Construction underway on $9 billion of warehouse space in U.S. The Supply Chain Xchange. https://proxy.qualtrics.com/

[18] Young, L., & Berger, P. (2025, January 3). Bracing for Tariffs, Logistics Operators Stand by Their Border Investments. Wall Street Journal. https://proxy.qualtrics.com/

[19] Vipers, G. (2024, December 19). Thousands of Amazon Workers Strike During Pre-Christmas Rush. WSJ. https://proxy.qualtrics.com/

[20] Young, L. (2024, December 6). Amazon’s New Robotic Warehouse Will Rely Heavily on Human Workers. Wall Street Journal. https://proxy.qualtrics.com/

[21] Berger, P. (2024d, December 27). Help Wanted: U.S. Factories Seek Workers for the Nearshoring Boom. Wall Street Journal. https://proxy.qualtrics.com/

[22] Mulvey, T. (2024, December 30). Tender rejection rates touch double digits briefly. FreightWaves. https://proxy.qualtrics.com/

[23] Strickland, Z. (2024, December 14). Rising rejection rates amid demand drop reveal truckload capacity exodus. FreightWaves. https://proxy.qualtrics.com/

[24] U.S. Energy Information Administration. (2024, December 30). Gasoline and Diesel Fuel Update December 30, 2024. Petroleum & Other Liquids. https://proxy.qualtrics.com/

[25] Kingston, J. (2024, December 30). Oil in 2025 increasingly looking like a buyer’s market. FreightWaves. https://proxy.qualtrics.com/

[26] Chirls, S. (2024d, December 30). Amid uncertain trade outlook, higher Asia-US container rates the only sure bet. FreightWaves. https://proxy.qualtrics.com/

[27] Mongelluzzo, B. (2024b, December 30). Trans-Pacific spot rates on the rise amid pre-Lunar New Year cargo bump | Journal of Commerce. Journal of Commerce. https://proxy.qualtrics.com/

[28] Knowler, G. K., Senior Editor. (2024, December 20). Tight capacity, high demand expected to push air cargo costs higher in 2025 | Journal of Commerce. Journal of Commerce. https://proxy.qualtrics.com/