U.S. Cutting Tool consumption up 8.1 percent in December

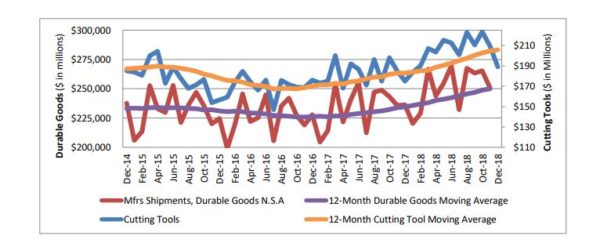

December 2018 U.S. cutting tool consumption totaled $189.1 million according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 9.7 percent from November’s $209.42 million and up 8.1 percent when compared with the $175 million reported for December 2017. With a year-to-date total of $2.47 billion, 2018 was up 12.5 percent when compared with 2017.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools. “December sales trended down 9.7% from a very good November and I believe that can be attributed to the holiday season and reduced number of working days. It was, however, the strongest December in the past three years and helped 2018 finish 12% higher than 2017,” said Phil Kurtz, President of USCTI.

According to Mark Killion, CFA, Director of US Industry at Oxford Econmics, “At the end of a strong year, new orders for cutting tools slowed in the last 2 months of 2018, although remaining 8% above year ago levels in December. Rising trade tensions and associated market turmoil, perhaps also the looming shutdown of federal government, likely gave key buyers reason to be more cautious, such as those in metals, transportation equipment and industrial machinery.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.