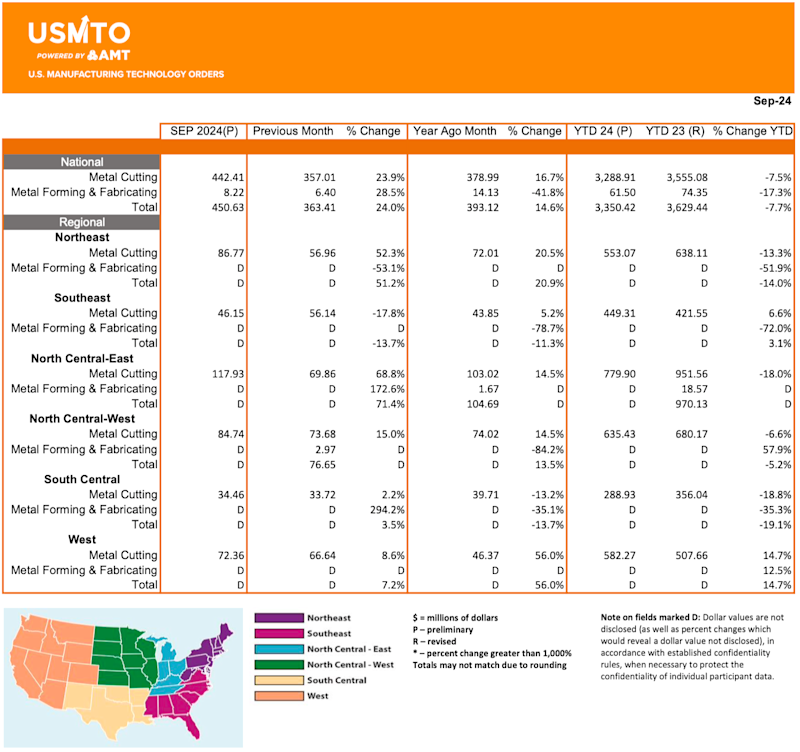

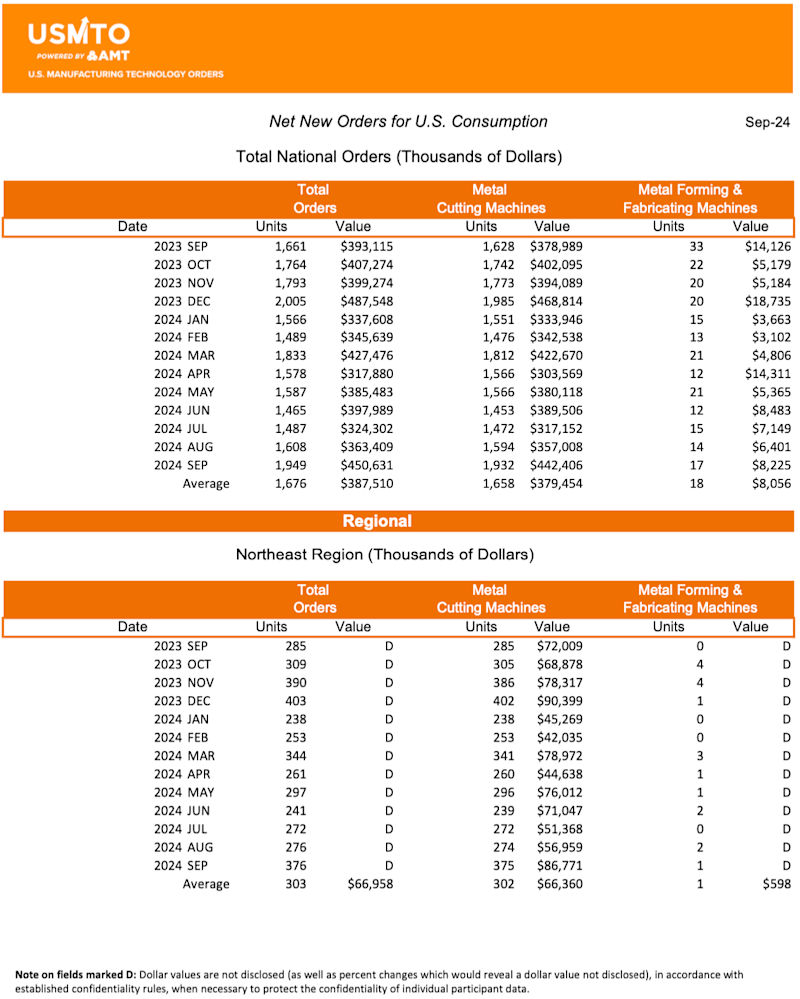

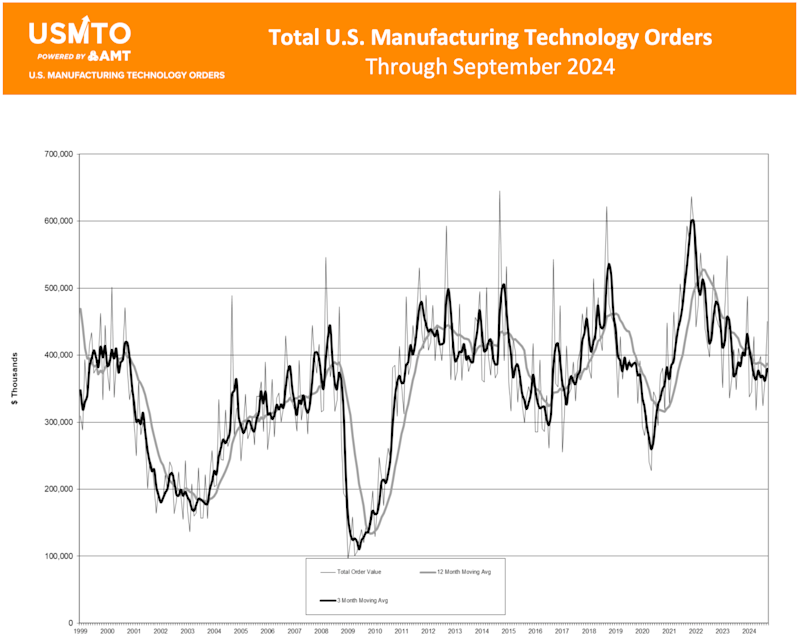

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders (USMTO) report published by AMT – The Association For Manufacturing Technology, totaled $450.6 million in September 2024. These orders for metalworking machinery increased 24% from August 2024 and increased 14.6% over September 2023 orders. Year-to-date orders reached $3.35 billion, a decline of 7.7% compared to the first three quarters of 2023.

Orders in September 2024 were at the highest level of the year and 5.1% above an average September. While this may be a good sign for an industry looking to find a bottom after nearly three years of decline, the optimism comes with a major caveat: orders were 9.1% lower than in an average IMTS September. Orders tend to peak for the year in September of even years, when IMTS – The International Manufacturing Technology Show, the largest manufacturing trade show in the Western Hemisphere, is held in Chicago. However, this year’s lower-than-average order level may be due to many show attendees planning for longer investment timelines.

- Contract machine shops, the largest customer segment for manufacturing technology orders, increased their orders to the highest level since March 2023. These job shops are a major bellwether for the wider industry, as sudden demand from this segment indicates that OEMs are increasing orders from them to meet additional capacity needs. If this demand remains elevated, it will typically lead to later investments across customer industries.

- The aerospace sector pulled back orders by nearly a third from August 2023. This is no surprise because the Boeing machinist strike caused major disruptions to the industry’s output beginning in the latter half of September 2024. Since the strike lasted for the entirety of October 2024, we can expect a similar drop-off in orders in next month’s report. New orders from airlines continued to roll in throughout the strike, and with the strike ending in November, the industry is positioned to finish the year with additional investments should capacity utilization quickly return to its pre-strike level.

- Orders from the automotive sector have lagged for most of 2024. This changed in September when manufacturers of automotive transmissions increased orders to their highest level since August 2023. This investment is not surprising, as automakers have been reassessing their outlook for the electric vehicle market throughout much of the year.

Throughout most of 2024, manufacturers hesitated to invest in manufacturing technology due to concerns over heightened interest rates and November’s U.S. presidential election. In September, the Federal Reserve cut rates after a year of its “higher for longer” monetary strategy to reduce inflation. We may not see the effects of this development until the October 2024 data is released, and the effects of a further rate cut and the effects of the presidential election may not be seen until the November data is released.

While these political and economic events may prove consequential to buying decisions, another major factor that could spur additional investment in the remaining few months of 2024 is the next step in the phase-out of the bonus depreciation allowance from the Tax Cut and Jobs Act of 2017. While investments in capital equipment are subject to 60% additional depreciation in 2024, that bonus will decrease to 40% in 2025. As the gap in orders between 2023 and 2024 has narrowed over the last two months, the reduction in headwinds puts the manufacturing technology industry in a position to end the year strong.