November Manufacturing Technology Orders climb setting up strong end to 2024

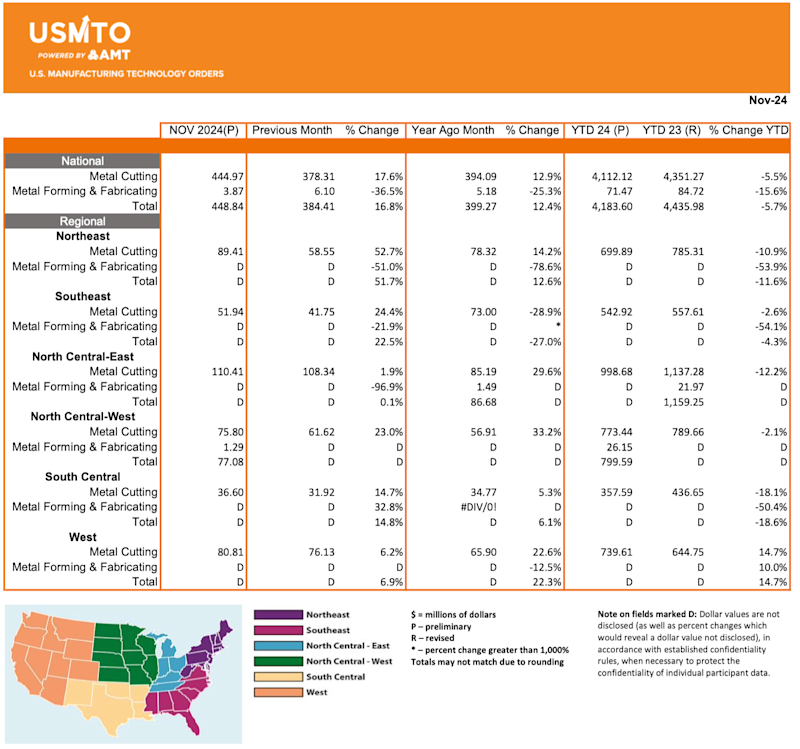

Orders of manufacturing technology, measured by U.S. Manufacturing Technology Orders report published by AMT, totaled $448.8 million in November 2024. These orders for metalworking machinery increased 16.8% from October 2024 and 12.4% from November 2023.

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders (USMTO) report published by AMT – The Association For Manufacturing Technology, totaled $448.8 million in November 2024. These orders for metalworking machinery increased 16.8% from October 2024 and 12.4% from November 2023. Year-to-date orders reached $4.18 billion, a decline of 5.7% compared to the first 11 months of 2023.

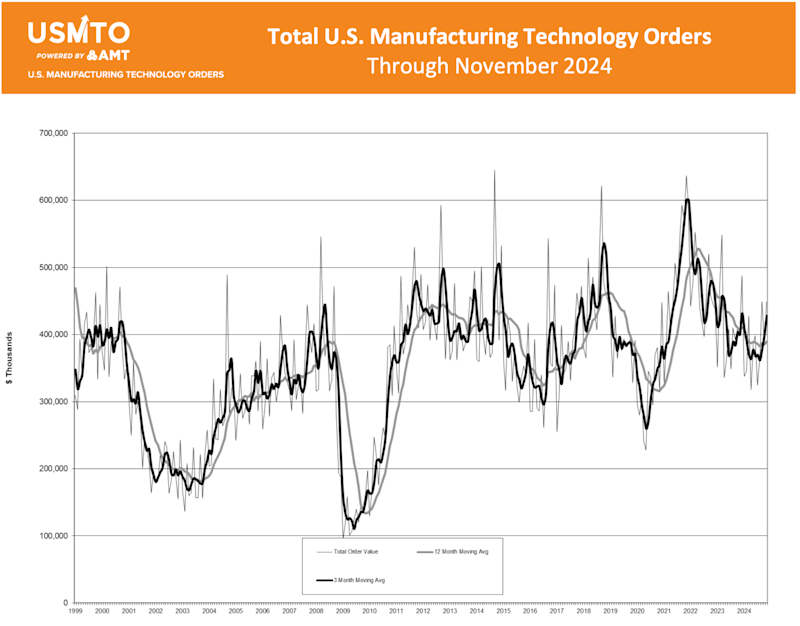

After a slow start to 2024, orders of manufacturing technology began trending upward following September’s IMTS – The International Manufacturing Technology Show. This continued in November, with new orders nearly 30% above a typical November and at the highest order level for any November since 2021. November 2024 orders nearly equaled those in September, when IMTS opened its doors at Chicago’s McCormick Place. This is further evidence of the lengthened buying cycle for metalworking machinery in recent months. As the impetus for capital investment shifts from augmenting capacity to quality and efficiency improvements, the time between an initial quotation and an order being placed has expanded.

Except September 2024, contract machine shops, the largest consumer of manufacturing technology, placed the largest order since March 2023. This is a welcome sign for the larger manufacturing sector, as these shops typically receive additional work when OEMs experience capacity constraints. Aerospace manufacturers decreased their orders modestly from October but remained slightly above their 2024 average, indicating the effects of the nearly two-month strike of Boeing machinists likely only shifted demand.

Although orders of manufacturing technology tend to correlate positively with interest rates over the long run, recent trends have shown more of the inverse correlation that conventional economic thinking would expect. This is in stark contrast to the previous example of an economic soft landing, where orders peaked along with interest rates and began to decline slightly as the Federal Reserve began loosening their monetary position. Given this trend, along with a tendency for manufacturers to expend their capital budgets by year’s end, orders from December 2024 could show a strong end to an irregular year.

Interested in More Financial Insights From AMT?

On Jan. 24, AMT will host the 2025 Winter Economic Forum, featuring the latest Oxford Economics forecast on the economy and manufacturing technology orders. AMT will also recap IMTS 2024 and share important can’t-miss industry insights to prepare manufacturers for the new year. Register for free to attend in person in Cincinnati, Ohio, or virtually.