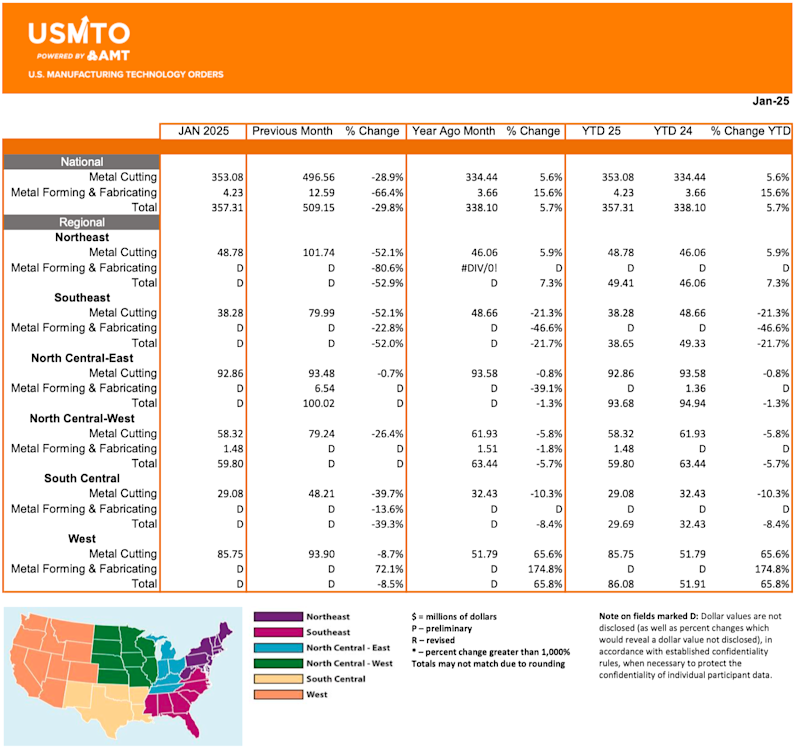

Orders of manufacturing technology totaled $357.3 million in January 2025, down 29.8% from December but up 5.7% from January 2024. While the order value was 16.2% higher than an average January, the units ordered were the lowest for any January since 2016.

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $357.3 million in January 2025, a 29.8% decline from December but a 5.7% increase from January 2024. Compared to an average January, the value of orders placed in January 2025 was 16.2% higher, making it the highest January since 2022. However, the number of units was 12.2% lower than the average January – the lowest level for any January since 2016.

Orders from contract machine shops, the largest customer industry, underperformed the market for much of 2024 but rebounded in the last four months of the year. That momentum did not carry into 2025, with machine shop orders in January declining by nearly one-third from December. While the monthly decline was the largest in any December-to-January period since 2020, the year-over-year decline from January 2024 was half the decline seen between January 2023 and 2024.

Aerospace orders in January hit their lowest monthly order level since the machinist strike at Boeing began in September 2024, coming in at nearly half of December 2024’s level. Despite the decline, orders were up 11% from January 2024, and output increased, indicating the potential for future demand. While the aerospace sector increased output in January 2025, overall manufacturing output fell modestly as output of motor vehicles and parts fell sharply. In this environment of falling output, automotive manufacturers reduced orders in January 2025 to almost two-thirds below their December 2024 levels. While most customer industries saw month-over-month declines, medical manufacturers increased their orders in January 2025 to the highest level since September 2023, underscoring the industry’s growing importance as a manufacturing technology customer.

After the shallow downturn of the last two years, order activity – measured both in value and units – seems to have found a bottom. In the recovery after the manufacturing downturn of 2015 and 2016, the market expanded from its bottom for 31 months to its next peak, which resulted in a cumulative 42% growth in orders. Thus far in 2025, industrial production remains flat, with capacity utilization dipping modestly in January after increasing for the final two months of 2024. If the data begins to show rising capacity utilization in February 2025 and beyond, we can expect order activity to gain momentum as the first quarter of 2025 comes to a close.

While the possibility of a strong opening to 2025 remains in sight, and rising utilization rates generally indicate an impending increase in order activity, Oxford Economics modestly downgraded their global growth forecast recently. They cited the rising uncertainty of global trade, which has caused hesitation among those making capital investments. Although we can see the ingredients for an impressive recovery before us, the actual outcome could be as flat as the table upon which they sit.