Manufacturing Technology orders fall for 3rd Year; beat expectations

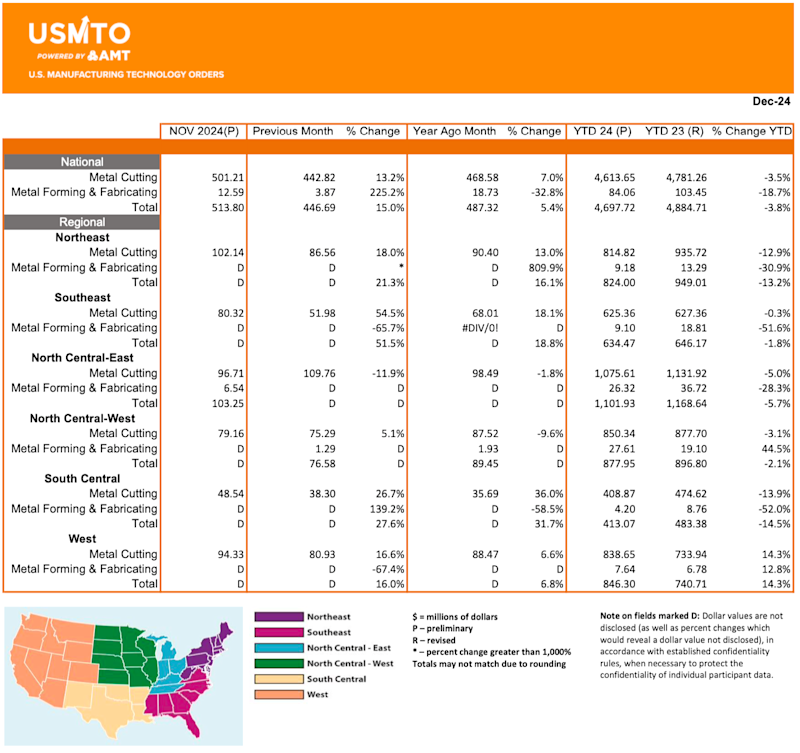

Orders of manufacturing technology, measured by the USMTO report published by AMT, totaled $513.8 million in December 2024, the highest level since March 2023. This showed an increase of 15% from November 2024 and was 5.4% behind December 2023.

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders (USMTO) report published by AMT – The Association For Manufacturing Technology, totaled $513.8 million in December 2024, the highest level since March 2023. These orders for metalworking machinery increased 15% from November 2024 and were 5.4% above December 2023. Year-to-date orders reached $4.7 billion, a decline of 3.8% compared to orders placed in 2023.

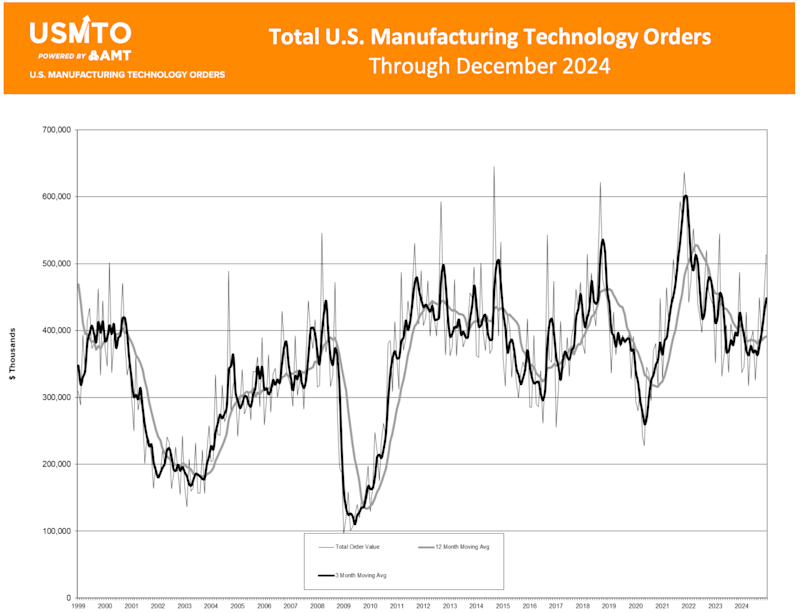

For the third consecutive year, machinery orders have declined. However, orders in 2024 were 9.7% above the annual average dating back to 1998, indicating that demand is resilient for machinery despite these declines. After a slow start to 2024, orders of manufacturing technology remained elevated following September’s IMTS – The International Manufacturing Technology Show. Although orders in September were modest compared to a typical IMTS year, the falloff in demand typically seen after the show did not happen, and 2024 ended in a strong position.

Orders from contract machine shops, the largest consumer of manufacturing technology, were a drag on the overall market in the beginning of 2024. That turned around toward the end of the year, when orders from this segment slightly outperformed the market, declining only 3.7% compared to 2023. Despite a lackluster year for Boeing, orders of manufacturing technology from the aerospace sector has increased significantly as the sector deals with ongoing capacity issues. December 2024 saw the highest order volume from this sector since December 2021, and total orders through the year increased nearly 32% from 2023. After three years of heightened investment, automotive manufacturers pulled back orders in 2024 by a quarter as demand for vehicles normalized and the industry braced for the potential impact of tariffs.

Nearly 40% of all orders in 2024 were placed since IMTS in September. This points to sustained demand for machinery heading into 2025. Through January 2025, quotation activity remained elevated, but the time between initial quotation and order was longer than usual. Forecasts presented at AMT’s annual Winter Economic Forum show promising signs for 2025, assuming geopolitical and trade disruptions are minimal.