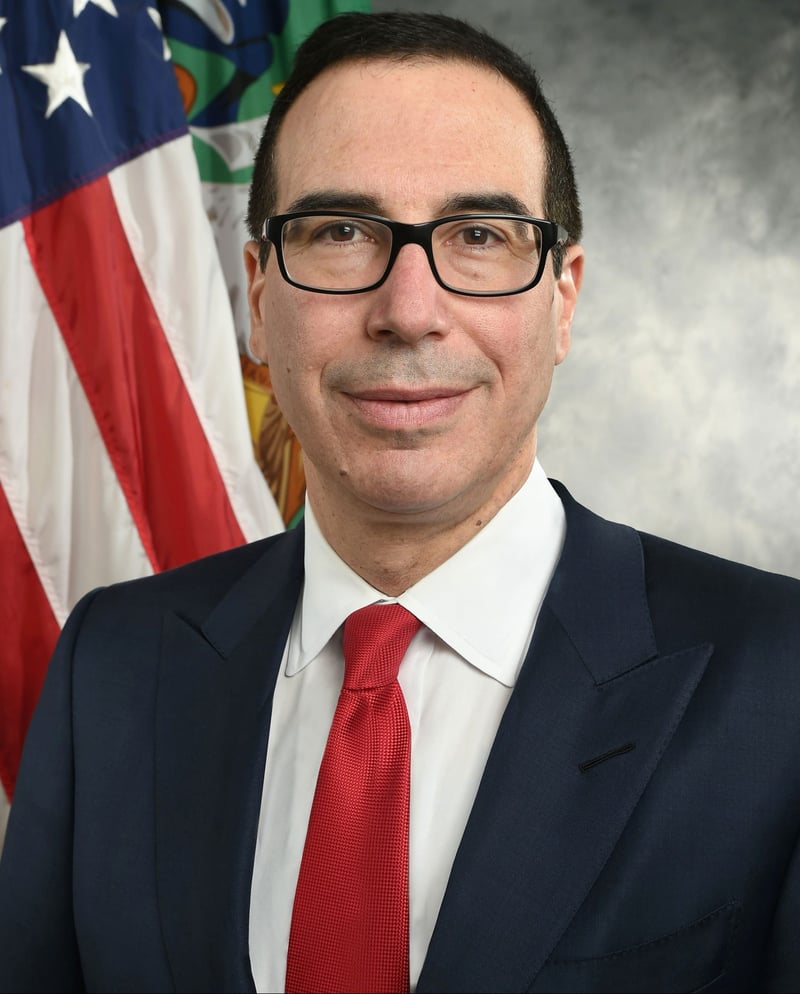

Steven Mnuchin

Steven Mnuchin IRS delays the April 15 tax payment deadline by 90 days

Most Americans can get a three-month reprieve to pay their income taxes for 2019, Treasury Secretary Steven Mnuchin said Tuesday, March 17, 2020 in a press conference.

The IRS will postpone the April 15th tax deadline by 90 days for millions of individuals who owe $1 million or less and corporations that owe $10 million or less, he said.

To be sure, Americans still have to meet the April 15 deadline if they are expecting a refund or are requesting a six-month extension, but they can defer payment for up to 90 days beyond that.

“If you owe a payment to the IRS, you can defer up to $1 million as an individual — and the reason we are doing $1 million is because that covers pass-throughs and small businesses — and $10 million for corporations, interest-free and penalty-free for 90 days. All you have to do is file your taxes,” Mnuchin said.

“We encourage those Americans who can file their taxes to continue to file their taxes on April 15 because for many Americans, you will get tax refunds and we don’t want you to lose out on those tax refunds,” Mnuchin said. “We want you to make sure you get them.”

“All you have to do is file your taxes,” Mnuchin said. “You’ll automatically not get charged interest and penalties.”