Hyster-Yale Materials Handling announces Fourth Quarter and Full Year 2019 results

Quarter Highlights:

- Consolidated revenues decreased modestly from Q4 2018 due to lower shipments caused by a moderating EMEA market, structural changes at the JAPIC operations and supplier issues

- Consolidated gross profit increased 15.8% over Q4 2018, driven by a 19.6% increase in Lift Truck gross profit

- Lift Truck gross profit margin increased to 16.3% from 13.7% in Q4 2018, with increases in all geographic segments due to cost recovery and pricing actions

- Consolidated operating profit increased to $8.1 million from a loss of $3.4 million in Q4 2018 but was reduced by an increase in product liability expense and investments to support strategic growth initiatives

- Q4 2019 consolidated net income increased to $3.4 million from a net loss of $1.2 million in Q4 2018

Hyster-Yale Materials Handling, Inc. has announced consolidated revenues of $834.8 million and consolidated net income of $3.4 million, or $0.20 per diluted share, for the fourth quarter of 2019 compared with $840.8 million and a consolidated net loss of $1.2 million, or $0.07 loss per share, for the fourth quarter of 2018.

Full-year 2019 lift truck shipments decreased to approximately 100,300 units from approximately 101,900 units in 2018, and consolidated revenues increased to $3.3 billion compared with $3.2 billion in 2018. Consolidated operating profit increased to $53.9 million in 2019 from $38.8 million in 2018. Consolidated net income was $35.8 million, or $2.14 per diluted share, for the year ended December 31, 2019, compared with consolidated net income of $34.7 million, or $2.09 per diluted share, for the year ended December 31, 2018. The Company’s reported tax rate was 23.6% for the year ended December 31, 2019, compared with 6.3% for the year ended December 31, 2018. The 2018 net income and reported tax rate included tax benefits of $4.4 million related to U.S. tax reform adjustments, whereas the 2019 net income and reported tax rate included incremental tax expense of $3.0 million for certain U.S. tax reform act provisions.

At December 31, 2019, the Company’s cash position was $64.6 million and debt was $287.0 million compared with cash on hand of $62.8 million and debt of $351.1 million at September 30, 2019, and cash of $83.7 million and debt of $301.5 million as of December 31, 2018.

For the 2019 full year, the Company’s consolidated cash flow before financing activities was $34.7 million, which was comprised of net cash provided by operating activities of $76.7 million less net cash used for investing activities of $42.0 million. For the 2018 full year, the Company’s consolidated cash flow before financing activities was a negative $43.3 million, which was comprised of net cash provided by operating activities of $67.6 million less net cash used for investing activities of $110.9 million, including $77.9 million for the acquisition of Maximal, net of cash acquired.

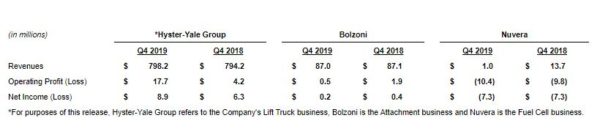

Segment Financial Results

Summary segment results for the Company’s three business segments were as follows for the fourth quarter of 2019 and 2018:

In late 2018, the Company announced that Bolzoni’s North America attachment manufacturing would be moved into Hyster-Yale Group’s Sulligent, Alabama manufacturing facility as part of a plan to expand Bolzoni’s capabilities in the United States. Effective January 1, 2019, the Sulligent facility became a Bolzoni facility. As a result of this reorganization, the 2019 and comparative 2018 financial information in this news release has been reclassified to reflect the Sulligent facility’s financial results within the Bolzoni segment.

Hyster-Yale Group Results

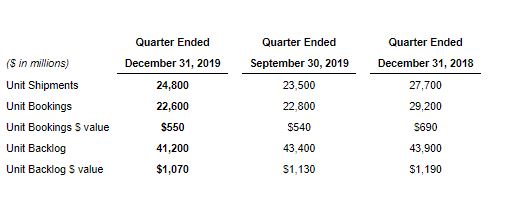

The following is a summary of Hyster-Yale Group unit shipments, bookings and backlog for the 2019 and 2018 fourth quarters and the 2019 third quarter.

Unit shipments improved over the 2019 third quarter, but decreased compared with the 2018 fourth quarter as shipments in the 2019 fourth quarter continued to be impacted, but to a lesser extent than in previous quarters, by a shortage of key components on certain heart-of-the-line products from key suppliers. While these supplier issues were generally resolved by the end of the fourth quarter, there will be some lingering effects in the first quarter of 2020. Lower bookings in the 2019 fourth quarter compared with the prior periods shown were partly a result of extended lead times on certain product ranges caused by the same supplier issues, as well as lower, but still robust, market levels. Backlog and the average sales price per unit in backlog decreased from the prior year and more modestly from the 2019 third quarter as a result of an increase in shipments of higher-priced units during the current quarter.

Americas Results

Revenues in the Americas segment, which includes the North America, Latin America, and Brazil markets, increased 5.7% to $545.3 million in the fourth quarter of 2019 from $516.1 million in the fourth quarter of 2018, despite a 500-unit decrease in shipments. This improvement was primarily the result of price increases implemented to offset material cost inflation and tariffs, as well as higher revenues from an increase in shipments of higher-priced Class 2 electric warehouse trucks and Class 5 Big Trucks in the North America market, which more than offset the revenue decrease from substantially fewer shipments of lower-capacity, lower-priced Class 1 and Class 5 trucks.

In the fourth quarter of 2019, operating profit in the Americas improved to $17.8 million from $4.0 million in the fourth quarter of 2018. Operating profit increased primarily as a result of improved gross profit partially offset by higher operating expenses. The increase in gross profit was mainly due to price increases to recover 2018 and 2019 material cost inflation, including continuing tariffs, as well as pricing actions applied throughout 2019, which matured during the fourth quarter of 2019. The improvement in gross profit from these benefits was partially offset by a shift in mix to lower-margin products and unfavorable currency movements.

Operating expenses increased primarily as a result of increased product liability expense, product development costs to support a planned major upgrade of several of the Company’s core product platforms and additional investments in the expansion of Hyster-Yale Group’s industry-focused sales and marketing teams.

EMEA Results

Revenues for the EMEA segment, which includes operations in Europe, Middle East, and Africa markets, decreased to $197.3 million in the fourth quarter of 2019 from $207.7 million in the fourth quarter of 2018. Revenues declined primarily due to a decrease in the unit and parts revenues and unfavorable currency movements of $6.8 million from the translation of sales into U.S. dollars. Unit shipments decreased across all EMEA regions by approximately 1,700 units, driven by all classes of lift trucks, with the exception of Class 5 Big Trucks. The decline in lower-capacity Class 5 lift truck shipments was the result of the same component shortages experienced in the Americas. Price increases implemented to offset higher material costs partly offset the revenue decrease.

Despite lower revenues, EMEA operating profit increased to $5.0 million in the fourth quarter of 2019 from $4.2 million in the fourth quarter of 2018 primarily as a result of improved gross profit, partially offset by higher operating expenses. The improvement in gross profit was mainly due to pricing actions on lift truck sales and a favorable shift in mix to higher-margin products, partially offset by unfavorable currency movements, higher material, and freight costs and increased warranty expense, as well as lower unit and parts volumes. The increase in operating expenses was driven by higher costs to support the Company’s strategic growth initiatives

JAPIC Results

Revenues in the JAPIC segment, which includes operations in the Asia and Pacific markets, including China, as well as results from Hyster-Yale Maximal, decreased to $55.6 million in the fourth quarter of 2019 from $70.4 million in the fourth quarter of 2018. The lower revenues were primarily driven by a decrease in shipments of approximately 600 units. During the 2019 fourth quarter, the Company implemented new ERP systems in JAPIC and launched new forklift truck models, as well as moved the JAPIC headquarters to a more centralized location in the region, all of which led to reduced productivity and, ultimately, the lower unit shipment levels during the quarter.

JAPIC generated an operating loss of $5.1 million in the fourth quarter of 2019 compared with an operating loss of $4.0 million in the fourth quarter of 2018. JAPIC’s operating results declined primarily as a result of lower parts margins and a shift in mix to lower-margin products.

Bolzoni Results

While Bolzoni’s 2019 fourth-quarter revenues of $87.0 million were comparable to the 2018 fourth-quarter revenues of $87.1 million, operating profit decreased to $0.5 million in the fourth quarter of 2019 from $1.9 million in the 2018 fourth quarter. The decrease in operating profit was primarily due to unfavorable currency movements.

Nuvera Results

Nuvera revenues decreased to $1.0 million in the fourth quarter of 2019 from $2.4 million in the third quarter of 2019 and from $13.7 million in the fourth quarter of 2018. During the fourth quarter of 2018, Nuvera recognized revenues that had previously been deferred on fuel cell battery box replacements (“BBRs”) sold. The decrease in revenues compared with the third quarter of 2019 was primarily the result of lower development funding associated with Nuvera’s third-party development agreements.

Nuvera’s 2019 fourth-quarter operating loss increased compared with the prior-year quarter mainly as a result of lower product development funding received from third parties. Despite an increase in the operating loss, Nuvera’s net loss was comparable to the prior-year quarter as a result of an accrued dividend from one of Nuvera’s investments.