Alta Equipment Group announces Second Quarter 2023 financial results

28990 Wixom Rd.

Wixom, MI 48393

Phone: 248 449-6700

Fax: 248 449-6701

http://www.altaequipment.com

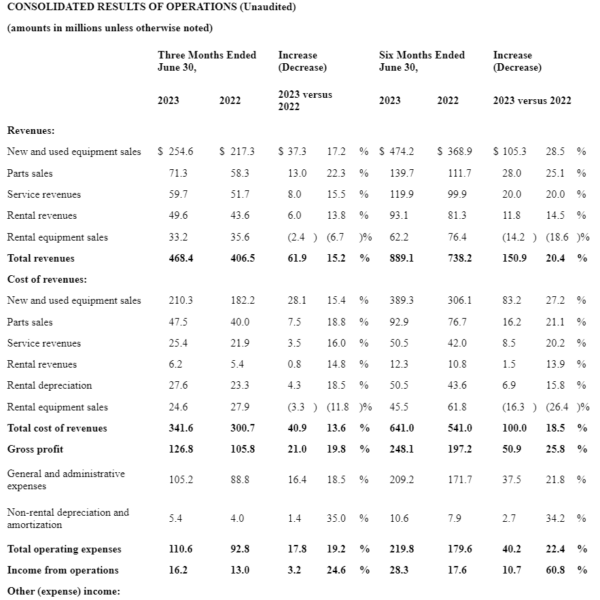

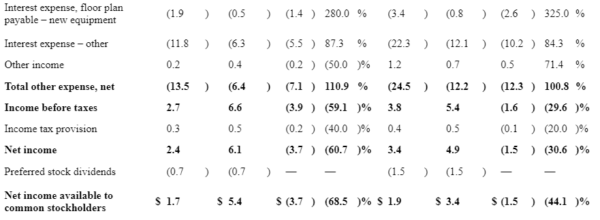

Second Quarter Financial Highlights: (comparisons are year over year)

- Total revenues increased 15.2% year over year to $468.4 million

- Construction and Material Handling revenues of $281.5 million and $169.1 million, respectively

- Newly introduced reporting segment, Master Distribution, with revenues of $21.4 million

- Product Support revenues increased 19.1% year over year with Parts Sales increasing to $71.3 million and Service Revenues increasing to $59.7 million

- New and Used Equipment sales grew 17.2% to $254.6 million

- Net income of $1.7 million available to common stockholders compared to $5.4 million in 2022

- Basic and diluted net income per share of $0.05 for 2023 compared to $0.17 in 2022

- Adjusted basic and diluted net income per share* of $0.19 for 2023 compared to $0.26 for 2022

- Adjusted EBITDA* grew 20.5% to $49.9 million, compared to $41.4 million in 2022

- Reaffirmed 2023 Adjusted EBITDA guidance of between $180 to $188 million

Alta Equipment Group Inc., a provider of premium material handling, construction and environmental processing equipment and related services, today announced financial results for the second quarter ended June 30, 2023.

CEO Comment:

Ryan Greenawalt

Ryan Greenawalt, Chief Executive Officer of Alta, said, “We delivered record second quarter results and remain positive on our outlook for the balance of this year and into 2024, as demand remains strong in our major end user markets. Our versatile and resilient business model is unique in the industry, as we offer the most expansive product offering and serve a diversified customer base across a vast range of industries. Our focus on driving and sustaining long-term equipment field population continues as we increased our number of factory trained and revenue producing technicians to approximately 1,300 at quarter end.”

Mr. Greenawalt continued, “Equipment supply chain issues continued to improve in the quarter and, as a result, we have invested in fleet and our inventory levels are returning to more normalized, pre-Covid levels, as we ensure equipment availability for our customers to meet their needs. Our ability to take delivery of new equipment from OEMs in the first half of 2023 was the primary driver of the $105.3 million increase in new and used equipment sales when compared to the same period for last year. In terms of our business segments, Construction and Material Handling both delivered solid year-over-year revenues growth and we expect those trends to continue. Our focus on electrification of commercial vehicles, while in its infancy, is beginning to take traction as we generated $3.1 million in revenues during the quarter with our first sale of Nikola’s TRE BEV tractors and complimentary charging units. Customer adoption is ongoing and increasing and we expect additional orders throughout the balance of this year.”

In conclusion, Mr. Greenawalt commented, “The macro trends in our end user markets remain positive and the newly announced federal spending initiatives will further extend the cycle. An estimated $1 trillion in spending is forecast in the IIJA, CHIPS and IRA legislation, and this funding could span more than seven years. In addition, U.S. governmental total transportation contract awards are at all-time highs. State DOT budgets are also at record levels in the Northeast and Southeast where we operate and we expect our end markets and customers to benefit from this spending. Lastly, our acquisition pipeline remains very active with numerous accretive opportunities that complement our existing business and support further geographic expansion.”

Full Year 2023 Financial Guidance:

- The Company maintained its guidance range and expects to report Adjusted EBITDA between $180 million and $188 million.

Recent Business Highlights:

- The Company’s Board of Directors approved its regular quarterly cash dividend for each of the Company’s issued and outstanding shares of common stock. The common stock dividend was $0.057 per share, or approximately $0.23 per share on an annualized basis. The common stock dividend was paid on May 31, 2023, to shareholders of record as of May 15, 2023.

- On June 28, 2023, the Company amended its ABL Facility along with its Floor Plan Facility, by and between the Company and other credit parties named therein, and the lender JP Morgan Chase Bank, N.A., as Administrative Agent. The amendments (i) exercised $55 million of the Company’s expansion option included in the Company’s asset-based revolving line of credit increasing borrowing capacity from $430 million to $485 million; (ii) provide for a $65 million expansion option allowing the Company to further increase borrowing capacity under the asset-based revolving line of credit to $550 million; (iii) increased the maximum borrowing capacity of its revolving floor plan facility by $10 million from $60 million to $70 million; (iv) provide for a $20 million expansion option allowing the Company to further increase borrowing capacity under the revolving floor plan facility to $90 million; and (v) increased permitted maximum borrowings under third-party floorplan facilities from $350 million to $390 million with additional annual 10% increases beyond 2023.