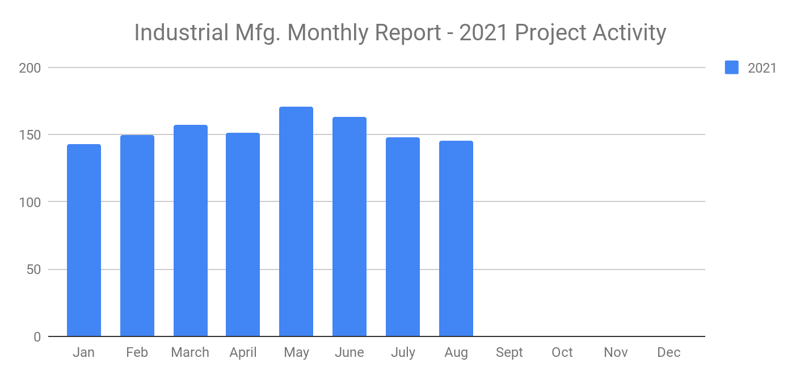

145 new Industrial Manufacturing planned Industrial Project Reports – August 2021 recap

SalesLeads just announced the August 2021 results for the newly planned capital project spending report for the Industrial Manufacturing industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction, and significant equipment modernization projects. Research confirms 145 new projects in the Industrial Manufacturing sector.

The following are selected highlights on new Industrial Manufacturing industry construction news.

Industrial Manufacturing – By Project Type

- Manufacturing/Production Facilities – 122 New Projects

- Distribution and Industrial Warehouse – 58 New Projects

Industrial Manufacturing – By Project Scope/Activity

- New Construction – 53 New Projects

- Expansion – 51 New Projects

- Renovations/Equipment Upgrades – 49 New Projects

- Plant Closings – 7 New Projects

Industrial Manufacturing – By Project Location (Top 10 States)

- North Carolina – 13

- Indiana – 11

- Texas – 10

- Michigan – 9

- Pennsylvania – 7

- Ohio – 7

- California – 7

- New York – 6

- Georgia – 6

- Iowa – 5

Largest Planned Project

During the month of August, our research team identified 14 new Industrial Manufacturing facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Rivian Automotive, who is considering investing $5 billion for the construction of a 12 million sf manufacturing facility and currently seeking a site in the FORT WORTH, TX area.

Top 10 Tracked Industrial Manufacturing Projects

ARIZONA:

Battery cell developer is planning to invest $1 billion for the construction of a 1 million SF manufacturing facility in BUCKEYE, AZ. Construction is expected to start in late 2021, with completion slated for Spring 2023. Construction will occur in multiple phases.

GEORGIA:

Medical device mfr. is planning to invest $500 million for the expansion of their manufacturing, laboratory, office, and training complex in PEACHTREE CORNERS, GA by 750,000 SF Construction will occur in multiple phases, with completion slated for 2024.

KENTUCKY:

Custom corrugated packaging products mfr. is planning to invest $400 million for the construction of a 1.1 million SF manufacturing facility in HENDERSON, KY. Construction is expected to start in early 2022, with completion slated for Fall 2023.

TEXAS:

A biotechnology company is considering investing $300 million for the construction of a processing facility and is currently seeking a site in the BRYAN, TX area. Watch SalesLeads for updates.

INDIANA:

A steel company is planning to invest $231 million for a 390,000 SF.expansion and equipment upgrades of their manufacturing facility in TERRE HAUTE, IN. They are currently seeking approval for the project.

ALABAMA:

Automotive components mfr. is planning to invest $130 million for the construction of a manufacturing facility in OPELIKA, AL. They have recently received approval for the project.

NORTH CAROLINA:

Consumer products mfr. is planning to invest $110 million for the construction of a manufacturing facility in GUILFORD COUNTY, NC. They are currently seeking approval for the project.

TENNESSEE:

An aluminum products mfr. is planning to invest $100 million for an expansion of their manufacturing facility in ALCOA, TN. They have recently received approval for the project.

NORTH CAROLINA:

Outdoor furniture mfr. is planning to invest $62 million for an expansion of their manufacturing facility in ROXBORO, NC. They have recently received approval for the project.

UTAH:

Insulation and roofing products mfr. are planning to invest $53 million for an expansion of their manufacturing facility in NEPHI, UT. They have recently received approval for the project.

About the Report

Since 1959, SalesLeads, based out of Jacksonville, FL has been providing Industrial Project Reports on companies that are planning significant capital investments in their industrial facilities throughout North America. Our professional research team identifies new construction, expansion, relocation, major renovation, equipment upgrades, and plant closing project opportunities so that our clients can focus sales and marketing resources on the target accounts that have an impending need for their products, services, and indirect materials.