Poor economic climate knocks warehouse construction

-

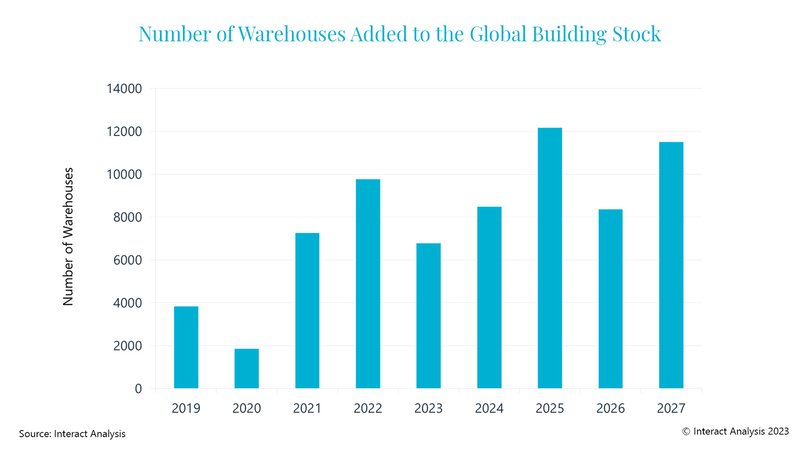

Warehouses added to the global building stock in 2023 down 35% compared with 2022.

-

26% of warehouses are expected to be automated by 2027, up from 18% in 2022

-

The Inflation Reduction Act, coupled with the trend toward near-shoring resulted in an uptick in durable manufacturing warehouses in Europe and North America

As with many other sectors, the recent economic downturn has hit the warehouse construction sector hard. Updated research by Interact Analysis suggests that fulfillment center construction has suffered in particular, partly driven by Amazon’s decreased spend on micro-fulfillment.

In response to the rising trend towards online shopping and e-commerce during the pandemic, we saw an increase in the construction of fulfillment centers to cope with this demand. Amazon accounted for a large proportion of this activity, as it doubled its fulfillment capacity between 2020 and 2021. But, as the trend towards e-commerce begins to slow down, the construction and building of new fulfillment centers have also dipped. In 2022, 4,000 fulfillment centers were added to the global building stock, but in 2023 this is forecast to decline to 2,000. Consequently, demand for end-to-end automation solutions will also decrease and the boom we saw during the COVID-19 pandemic will come to an end. Many companies are likely to focus on automating their existing assets rather than investing in new, larger projects.

Warehouse construction has also suffered from the effects of poor economic conditions across much of the globe, in particular rising interest rates. It is expected the US will see a “meaningful” downturn within the next 12 to 18 months and, consequently, Interact Analysis forecasts a decline in the rate of warehouse construction in the coming years. Despite this, the growth in e-commerce since the pandemic is likely to dampen the shock to the warehouse construction sector. This is a lagging indicator, so a significant decrease is expected in 2H 2023 and 1H 2024. Overall, 6,700 warehouses will be added to the global building stock in 2023, a reduction of 35% compared with 2022, but still higher than pre-COVID levels.

Overall, China and the US are leading the way in terms of warehouse construction. In 2022, the two countries combined accounted for 58% of the total square footage added. The US’s total warehousing stock increased by 6% over the year and China’s by 5%. The updated research shows that Japan and France registered the lowest growth in terms of additional warehouse square footage in 2022.

Rueben Scriven, Research Manager at Interact Analysis, says, “It is important to realize the downturn in warehouse construction is not due to a lack of demand. Rather, it is due to high-interest rates and poor economic conditions. The slowdown in warehouse construction is likely to be short-lived as the demand for sites is still there. Rent prices are anticipated to increase in the mid-term and e-commerce will continue to drive demand over the long term.

Regarding automation, although we expect to see a decrease in demand for end-to-end automation, by the end of 2022, 18% of all warehouses had some form of automation installed and this is set to increase to 26% by the end of 2027. Food & beverage warehouses, and parcel sectors report the highest levels of automation in their warehouses.”

About the Report:

“Lockdowns and social distancing measures implemented to mitigate the COVID-19 pandemic caused a wholesale disruption of traditional brick-and-mortar retail. In less than a year, US e-commerce penetration rose from ~10% of all retail sales in late 2019 to roughly 15% by the end of 2020. With global e-commerce online sales projected to more than double over the next five years, 28,500 warehouses will be added to the global stock. A significant portion of these new warehouses will be direct-to-consumer fulfillment centers necessitating significant labor and automation investments.”

IA’s Warehouse Building Stock Database is the ONLY report on the market that estimates warehouse counts, footprint, sizes, labor demand, and automation penetration as a single, consistent, and global dataset. We’ve consolidated and analyzed data points from government sources, public company filings, and industry sources into a model that provides detailed and credible warehouse estimates – all regularly updated to incorporate new information, outlooks, and segmentations.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth. To learn more, visit www.InteractAnalysis.com