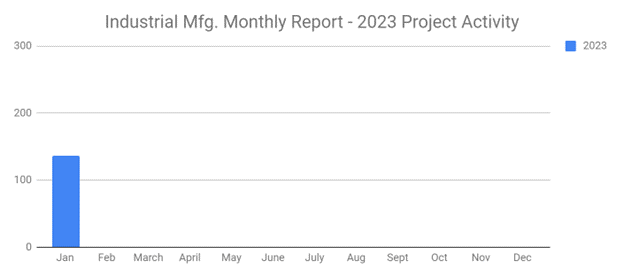

New Industrial Manufacturing planned projects drop 36% in January 2023 from previous month

IMI SalesLeads announced the January 2023 results for the newly planned capital project spending report for the Industrial Manufacturing industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction, and significant equipment modernization projects. Research confirms 130 new projects in January as compared to 177 in December 2022 in the Industrial Manufacturing sector.

The following are selected highlights on new Industrial Manufacturing industry construction news.

Industrial Manufacturing – By Project Type

- Manufacturing/Production Facilities – 111 New Projects

- Distribution and Industrial Warehouse – 69 New Projects

Industrial Manufacturing – By Project Scope/Activity

- New Construction – 36 New Projects

- Expansion – 51 New Projects

- Renovations/Equipment Upgrades – 53 New Projects

- Plant Closings – 13 New Projects

Industrial Manufacturing – By Project Location (Top 10 States)

- Georgia – 10

- New York – 14

- Indiana – 8

- Texas – 8

- Wisconsin – 8

- California – 7

- Florida – 7

- Michigan – 7

- Alabama – 6

- South Carolina – 6

Largest Planned Project

During the month of January, our research team identified 14 new Industrial Manufacturing facility construction projects with an estimated value of $100 million or more.

The largest project is owned by General Motors, who is planning to invest $795 million for the renovation and equipment upgrades on their manufacturing facilities in FLINT, MI, and BAY CITY, MI. They are currently seeking approval for the project.

Top 10 Tracked Industrial Manufacturing Projects

TEXAS:

EV mfr. is planning to invest $770 million for the expansion of their manufacturing facility in AUSTIN, TX by 1.4 million sf. Construction will occur in four phases, with the completion of the first phase slated for early 2024.

WEST VIRGINIA:

An energy storage technology company is planning to invest $760 million in the construction of a battery manufacturing facility in WEIRTON, WV. They are currently seeking approval for the project. Completion is slated for 2024.

NUNAVUT:

A mining company is planning to invest $483 million in the construction of a processing facility in KITIKMEOT, NU. Construction is expected to begin in 2023, with completion slated for 2025.

NORTH CAROLINA:

A pharmaceutical company is planning to invest $450 million for the expansion of its processing facility in DURHAM, NC. They are currently seeking approval for the project. Completion is slated for 2027.

GEORGIA:

A specialty contractor is planning to invest $420 million in the construction of a manufacturing facility in LOCUST GROVE, GA. They are currently seeking approval for the project. Completion is slated for 2025.

TENNESSEE:

Automotive mfr. is planning to invest $250 million for the expansion of its manufacturing facility in DECHERD, TN. They are currently seeking approval for the project.

KENTUCKY:

Steel products mfr. is planning to invest $244 million for the expansion, renovation, and equipment upgrades on their manufacturing facility in GHENT, KY. They are currently seeking approval for the project.

GEORGIA:

Automotive component mfr. is planning to invest $205 million for the construction of a manufacturing facility at 4822 Hwy 301 S. in STATESBORO, GA. They have recently received approval for the project. Completion is slated for Fall 2024.

TENNESSEE:

Tire mfr. is planning to invest $174 million for a 600,000 SF expansion and equipment upgrades at their manufacturing and distribution facility in DAYTON, TN. They have recently received approval for the project.

INDIANA:

Material handling equipment mfr. is planning to invest $130 million for the construction of a manufacturing and office facility in NOBLESVILLE, IN. They have recently received approval for the project. They will relocate their headquarter operations upon completion.

About the Author:

Since 1959, IMI SalesLeads, based out of Jacksonville, FL has been providing Industrial Project Reports on companies that are planning significant capital investments in their industrial facilities throughout North America. Our professional research team identifies new construction, expansion, relocation, major renovation, equipment upgrades, and plant closing project opportunities so that our clients can focus sales and marketing resources on the target accounts that have an impending need for their products, services, and indirect materials.