LtoR: Perc Pineda, Ph.D. and Ingo Borchert, Ph.D.

LtoR: Perc Pineda, Ph.D. and Ingo Borchert, Ph.D. A Transatlantic Conversation: Economists discuss Post-Pandemic Global Trade

As global trade slowed in 2020, the US plastics industry experienced its first trade deficit after many years of a trade surplus. Year-to-date data ending in September shows a $1.4 billion US plastics industry trade deficit. It is likely that the US will have another year of a trade deficit in plastics, albeit less than last year.

Now that 2021 is ending, what’s the trade outlook for 2022?

I reached out to a trade expert I met during my days at the International Monetary Fund (IMF). Ingo Borchert, Ph.D. was an Economist at the World Bank in 2008-2011. He co-created the global “Services Trade Policy Database,” which is jointly published by the World Bank and the World Trade Organization (WTO), as well as the “International Trade and Production Database.” Given his role as Deputy Director of the UK Trade Policy Observatory at the University of Sussex, I was keen on getting Ingo’s insights on UK trade considering their position as a major plastics trade partner of the US. However, our interesting conversation took us beyond US-UK trade, covering the many facets of global trade.

A Transatlantic Conversation on Post-Pandemic Global Trade

Pineda: For the plastics industry, the world is our market. What’s your post-pandemic trade outlook? What can you suggest to policymakers to keep trade going, as countries emerge from the pandemic?

Borchert: I would very much hope that we are about to emerge at the other end of the tunnel. Yet currently, the UK looks set to be heading straight into the fourth wave, much like many other European economies. Thus, it could be a little longer until we see a broad-based recovery taking hold. But policymakers can make a difference. The protectionist bickering in the past certainly wasn’t helpful, neither the trade war with China nor the controversy over the distribution of vaccines and exports of PPE equipment. But I see signs of the dialogue coming back on track; for instance, the Trade and Technology Council (TTC), as a transatlantic forum to coordinate trade policy between the US and the EU, is an encouraging step. In the longer term, I would hope that policymakers see—indeed, rediscover—the benefits of international integration. That is a message that needs to be heard in the UK more right now than anywhere else.

Pineda: There is a consensus that trade volume will increase this year. The IMF now expects trade in goods and services to increase 9.7% this year and 6.7% next year. The latest forecast by the WTO calls for a 10.8% increase in merchandise trade from 2020, followed by a 4.7% increase in 2022. Is it possible that trade next year could grow above forecast—considering the uneven reopening of economies and that other countries are yet to re-engage in trade at pre-pandemic levels? What could cause trade to grow faster next year?

Borchert: I suspect that some of these seemingly high-growth forecasts next year are base effects, meaning that they reflect the statistical phenomenon that any quantity that has taken a big hit will exhibit high growth rates when it rebounds, simply because the base has shrunk so much in the reference period. But of course, I would also hope for some genuine growth. The pandemic will probably lead to a long-lasting change in the composition of trade; for instance, more towards services trade, at least relatively speaking. Digital trade and merchandise goods that are amenable to e-commerce will certainly grow and grow faster, than other categories such as Travel or Transport, which are going to reel from the pandemic shock for some more time. Business travel may perhaps never go back to pre-COVID levels. But the recovery of value chains and stronger consumer demand once the pandemic is overcome should generally contribute to trade growth.

What worries me a little bit is that inflation expectations are significantly up (5% in the US and 3% in the UK over one year). Higher prices are good for some businesses but if that trend continued it could curtail demand, especially since employment levels in many economies are still substantially below pre-pandemic projections, and it could spell an end to the very accommodating monetary policy that has almost become the new normal.

Pineda: I do share your concerns. It was not expected that inflation would increase to these levels in a short amount of time. The demand and supply adjustments of economies coming out of the pandemic were not expected to be as uneven as what we’ve been experiencing. It appears that UK inflation has been running less than the US. This brings me to my next question. The UK is a major trade partner of the US in plastics and plastics products. It was expected that Brexit would result in trade diversion. Is it too early to assess the impact of Brexit on the UK’s trade with the EU and the US?

Borchert: No, it is not too early to look at some figures if we are prepared to take the latest monthly trade figures with a grain of salt; moreover, mind that it is very hard to disentangle Brexit trade effects from the pandemic shock. Having said that, the numbers suggest that UK trade took a substantial hit after the Brexit transition period, which had ended on 31 Dec 2020. In one of the first studies on 2021 Brexit effects, which we published a few days ago, we find that over the period January-July 2021, UK exports to the EU fell by 14% and UK imports fell by a whopping 24% (or £32.5 billion), relative to non-EU partners. In January 2021, UK exports of plastics and rubber products to the EU tanked by 44.3%, although these exports have since recovered somewhat and appear to be back to average 2017-20 levels. At the same time, UK imports of plastics and rubber from the EU show a persistent negative impact of about -25% across all months. It is not implausible to think, as you suggested, that some of these imports may now be sourced from the US instead.

Pineda: Any thoughts on how the UK’s trade relations with the EU and the US will change?

Borchert: UK-EU trade relations have hit an all-time low and there is currently little political will to normalize trade relations. The UK-EU Trade and Cooperation Agreement is a living document, though, and can be built upon in individual areas as and when parties see the benefit of doing so. Apart from the EU, the UK is obviously keen on signing trade deals with other countries including the US, even though the UK’s trade is naturally focused much more on the EU as its biggest and geographically closest trading partner. For instance, in the plastics and rubber industry the UK exports about 60% of its value-added to the EU-27 and only about 10% to the US.

A free trade agreement with the US is a long shot and, it seems to me, not currently a priority for the US administration. Yet gains could be had in areas such as services; the UK is currently exporting over £80 billion worth of services to the US and conversely, the UK is an important market for US services and investment. So, there are opportunities, but I wouldn’t hold my breath.

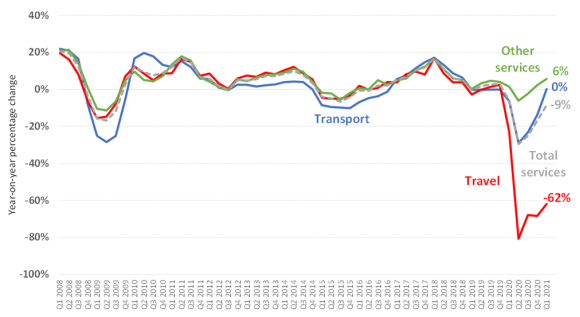

Figure 1: WTO press release 889, 4 Oct 2021, Chart 4.

Pineda: Yes, the Biden Administration seemed to have underscored multilateralism as the defining characteristic of its trade policy agenda. But what about services? Plastics are widely used in the services sector such as in the travel and leisure industry. The WTO also expects trade in services to lag merchandise trade. Are there projections out there on what trade services would like in 2022?

Borchert: General statements about services trade are difficult because it is such a mixed bag and the impact of the pandemic has been very uneven, as can be clearly seen in Figure 1. Travel has been hit badly, unsurprisingly, but other services are well up and running again. Apart from Travel and Transport, which for most countries account for some 10-15% of their services trade, all other services (green line) have held up remarkably well. This reflects a general stylized fact. Compared to goods trade, the value of services trade is often more resilient in times of crisis. Demand for services is less elastic and many high-skilled services are tailored to customers’ needs. Indeed, I would reckon that many firms in the plastics trade are services traders themselves. This resilience, and the derived demand for plastics products, should contribute to a more positive outlook even when a full recovery may be more protracted.

Let’s also not forget that a lot of services are traded indirectly by being embodied as inputs into merchandise goods exports, including plastic products. As of 2018, more than a third of the value of UK exports in the plastics and rubber industry (37%) consisted of services value-added. Isn’t that a surprisingly large number? As the plastics industry evolves and innovates, I would expect the services-content of plastics export to increase further as more and more research spending or financial services are incorporated.

Pineda: That is surprising. And yes, the services-content of plastics would increase. What about post-pandemic, what are your thoughts on trade-in services?

Borchert: On a longer-term horizon, I think that the “digitization shock” induced by the pandemic (e.g. working from home via digital technologies) will very likely have a lasting impact on how business is being conducted, including how services might be traded internationally. As such, the pandemic has only reinforced a secular trend that had been underway well before the pandemic. It is estimated that about 60-70% of UK services exports are “potentially digitally-enabled”, and the lockdowns will have sped up the transition from “potentially” to “actually” digitally delivered services trade. It is probably not a coincidence that 63.5% of overall UK exports to the US were in services in 2020, compared to 36.5% of goods exports. Would you have guessed that services trade was nearly twice as large as goods trade?

Pineda: No, I wouldn’t have guessed that. Plastics and plastic products are ubiquitous in the digital space of electronics and connectivity. Growth in the digital-enabled services trade you mentioned would lead to an increased usage of plastics. Although, at the height of the pandemic, concerns about globalization were amplified in the media. I don’t believe that COVID-19 is the beginning of the end of globalization. However, it has elevated the discussion on the importance of resilient supply chains across borders. What are your thoughts on trade agreements? The US, Mexico, and Canada – under the United States Mexico Canada Trade Agreement – is a robust trade bloc. The manufacturing and services supply chains of the three countries are linked. All three countries have substantial plastics trade. Should countries have more regional trade agreements? How about multilateral trade agreements? What about a bilateral trade agreement?

Borchert: For as long as multilateral talks at the WTO are effectively stalled, plurilateral and bilateral trade agreements are a useful strategy to tackle tariff and non-tariff trade barriers, especially so-called “deep” trade agreements that cover a wide array of issues including chapters on trade facilitation, digital trade, investment, and intellectual property rights. This comprehensive approach supports value chain trade, for which firms need to coordinate flows of goods, services, capital, and knowledge. The World Bank has just concluded a big project on the “Economics of Deep Trade Agreements”—for which I was involved in analyzing Services Trade Agreements—that demonstrates the effectiveness of deep trade agreements. That said, issues remain with regard to implementation and utilization rates. Trade agreements are only as good as governments choose to implement them since there’s a lot of endeavor language in these agreements.

So, whilst trade agreements can be very useful, I would caution against putting all our hopes in these devices for two reasons. First, the iron forces of gravity continue to shape trade flows as they ever did – that is, firms will trade more with markets that are larger and more proximate. That’s the reason why merely 2% of UK services exports go to Japan. Last year’s UK-Japan Economic Partnership Agreement, even though hailed as one of the most advanced agreements, is unlikely to change that figure by much. Second, the three big players on the global trade scene—the US, the EU, and China—use trade agreements to set a precedent for their approach to a variety of policy issues e.g., personal data governance. The world is currently falling into three “digital realms” underpinned by respective templates for trade agreements. More should be done to work towards a multilateral solution. On the one hand, multilateral negotiations just scored a small victory a few days ago as the Joint Statement Initiative on services domestic regulation was agreed, and I hope more such steps will follow. On the other hand, “digital economy agreements” are the new kid on the block and these can be formulated as so-called ‘open plurilateral agreements’, which will allow countries to move forward without creating stumbling stones for the WTO.

Pineda: True, but with digital economic agreements (DEAs), do you think it would address intellectual property rights issues? If countries enter a DEA, it seems logical to assume that they would have similar national intellectual property right (IPR) rules. After all, DEAs establish digital rules and digital economic collaborations between countries. Our industry is concerned with IPR. Plastics are the result of innovation. Our industry is concerned with IPR across the value chain – plastics materials and resin, machinery, plastics products, molds for plastics. Outside of the WTO’s Agreement on Trade-Related Aspect of Intellectual Property Rights (TRIPS), how can businesses minimize intellectual property infringement?

Borchert: I share your concern that violations of Intellectual Property Rights (IPR) often exert a chilling effect on trade and, even more so, on foreign direct investment. Different industries or value chains develop their own approaches to deal with this problem. When IPR protection is weak or cannot be enforced, bringing a foreign partner into the fold by acquiring ownership can be a solution. IPR chapters in trade agreements can also help, but again the devil is in the details as to which of these provisions are binding (as opposed to aspirational) and whether these provisions are then subject to the trade agreement’s dispute settlement mechanism. I may be preaching to the choir but for me, strong IPR protection is a win-win situation, not only for the foreign firm but also for the trade/investment partner, as there is a large literature that has documented the benefits to the host economy of inward investment. Yet this will only happen if firms can be assured that their IPR assets are safe.

Pineda: That was indeed insightful, thank you. It was good catching up.

Final Thoughts

The global economy continues to emerge from the pandemic but with the undercurrent of risks from coronavirus variants. With new multilateral trade initiatives, higher services trade, the 2022 global trade outlook appears brighter than 2021 albeit chances of US-UK trade remain slim.

About Plastics Industry Association

The Plastics Industry Association (PLASTICS) is the only organization that supports the entire plastics supply chain, representing nearly one million workers in the $395 billion U.S. industry. Since 1937, PLASTICS has been working to make its members and the industry more globally competitive while advancing recycling and sustainability. To learn more about PLASTICS’ education