October 2024 Logistics Manager’s Index Report® LMI® at 58.9

Growth is INCREASING AT AN INCREASING RATE for: Warehousing Utilization, Transportation Capacity, Transportation Utilization, and Transportation Prices.

Growth is INCREASING AT A DECREASING RATE for: Inventory Levels, Inventory Costs, Warehousing Capacity and Warehousing Prices

The October Logistics Manager’s Index reads in at 58.9, up (+0.3) from September’s reading of and at its highest levels since September 2022. The overall index has now increased for eleven consecutive months, providing strong evidence that the logistics industry is back on solid footing. The clearest example of this is the jump in the expansion for Transportation Prices which were up (+5.7) to 64.1, which is the fastest rate of growth for this metric since May of 2022. Transportation Capacity was fairly consistent with last month, increasing very slightly (+0.8) to 50.8 and implying very minimal levels of growth. Interestingly, Transportation Capacity actually contracted in the first half of October (45.8) before expanding again later in the month (54.3). It will be interesting to see if capacity continues to loosen in November or if it moves back towards no change. It is possible that as Transportation Prices continue to rise more idle capacity will come off the sidelines to take advantage of the increased opportunity, leading to the somewhat counterintuitive situation that we now find ourselves in where both Transportation Prices and Capacity are increasing. By contrast, our three warehousing metrics have remained fairly stable as capacity grows at a steady rate (-0.1 to 55.8) and Warehousing Utilization (+1.9 to 62.9) and Warehousing Prices (-1.1 to 65.8) are relatively consistent with the changes observed in September. Underlying all of this is the continued expansion of Inventory Levels (-0.4 to 59.4) and Inventory Costs (-5.5 to 65.8). Breaking the streak of the last 6 months, more Inventory Level expansion is now coming from Downstream retailers (65.7) than from Upstream firms (56.3), suggesting that retailers are stocked up, and will likely continue to stock up, for the holiday shopping season.

Researchers at Arizona State University, Colorado State University, Florida Atlantic University, Rutgers University, and the University of Nevada, Reno, and in conjunction with the Council of Supply Chain Management Professionals (CSCMP) issued this report today.

Results Overview

The LMI score is a combination of eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in October 2024.

The LMI read in at 58.9 in October, which is up (+0.3) from September’s reading of 58.6. This is the fastest rate of expansion for the overall index since September of 2022. While this is the 25th consecutive reading below the all-time average of 61.8 for the overall metric, the current trajectory suggests that may not be the case for much longer.

The sustained growth in the LMI over the last few months is reflected in the steady growth of the U.S. economy throughout Q3. The 2.8% growth was driven largely by consumer spending, which was up 3.7% year-over-year (up from the 2.8% y-o-y growth in Q2), as well as an 8.9% growth in exports[1]. The increased consumer spending in Q3 was likely one of the signals firms have relied on in their decisions to increase exports throughout the second half of 2024. Spending may have been driven by the continued deceleration of inflation, as the PCE was only up 1.5% year-over-year in Q3, which is the lowest quarterly rate of inflation growth in four years. Core PCE inflation, which excludes food and energy, read in at 2.2%. Drilling in to a more micro level, core September PCE was up 2.1%, down from the 2.7% growth seen a year ago and essentially in line with the Fed’s stated target of 2% annual growth[2]. There are also some indicators that inflation will continue slowing, as wholesale prices in the U.S. were unchanged month-over-month in September – standing in contrast to the 2.8% increase seen over the same period in 2023. Because wholesale price increases are generally passed down to retailers and consumers, this stabilization may represent some price relief yet to come[3]. In the last week of October, The Conference Board reading of U.S. consumer confidence jumped up to 108.7. This is an increase of 9.5-points which is the largest jump since March of 2021. The proportion of respondents anticipating a recession in the next year also fell to its lowest level since July of 2022 (which was the first month the question was included in the survey)[4].

It was not all positive news in October. The U.S. added only 12,000 jobs which was significantly below expectations and is down from previous months. Transportation and warehousing jobs remained essentially unchanged in October, which is not what one might expect heading into the traditional peak season[5]. This low number was at least partially due to strikes at Boeing, and the aftermath of the two hurricanes that hit the East Coast early in the month[6] and may have cost the economy somewhere around 100,000 jobs[7]. However, even with those anomalies, job growth has been slowing over the last three months, providing another indication that the level of economic growth in the U.S. has moved to a more sustainable level and that interest rates can continue to come down. A big reason for the slowing rates of inflation is how well supply chains are working right now. According to the San Francisco Fed, supply-driven inflation was negative in September, meaning that the abundance of goods such as fuel, consumables, and groceries drove prices down. This marks the third time in the past 10 readings that supply has been deflationary for the U.S. economy[8]. Taken altogether, the news on inflation has caused analysts to expect that the Fed will cut interest rates by another quarter point at their meeting this week and several more times in 2025[9].

The slowing rate of inflation is likely behind the continued strength of the American consumer. Consumer spending is highlighted by Amazon’s robust Q3 numbers, in which they reported $158.9 billion in sales, with much of it driven by greater-than-expected activity in its retail business. Amazon expects continued growth, predicting sales of $188.5 billion in Q4[10]. The retailer’s October Prime Day can be a canary in the coalmine for holiday ecommerce sales. The numbers for the 2024 event were the largest in firm history[11], suggesting that more consumer activity may be on the horizon in Q4. Based on the level of inventories moving around U.S. supply chains it is clear that retailers are expecting strong consumer spending to continue. Inventory Levels continue to grow (-0.4) at a rate of 59.4. These numbers are even strong for Downstream retailers, who reported their most robust expansion of 2024 with a growth rate of 65.7, outstripping their Upstream counterparts (56.3). Interestingly, only a marginal difference exists for Inventory Costs between Upstream (66.4) and Downstream (64.7) firms. The metric continues to grow at 65.8 overall, but at a slightly slower pace (-5.5) than we saw in September.

Our inventory metrics were both significantly more robust in early October. Inventory Levels read in at 66.7 earlier in the month, and then dropped to a slower expansion of 54.1 in the back half. The same was true for Inventory Costs, which read in at 71.4 in early October and then dropped to 61.9 in the second half of the month. When taken together, this suggests that seasonal inventories likely peaked in mid-October and will now come down (while still being continually replenished) due to holiday shopping. This would be consistent with what we saw in the past two years, when seasonal inventory growth peaked in October and then slowed down through November and December. The only time in recent history that this did not happen was in December of 2021, which we now know was a precursor to the inventory bullwhip that staggered retailers in early 2022 and was the genesis of the freight recession.

Inventory growth may slow down, but the JIT-nature of U.S. retail supply chains means that it will still continue to flow in through U.S. ports. TEU volumes coming through the Port of Los Angeles were up 190% year-over-year as more inventory shifted to the West Coast due to the twin hurricanes and 3-day work stoppages that impacted East and Gulf Coast ports early in the month[12]. The increased volume has been good for maritime shippers. Maersk reported revenues of $15.8 billion in the quarter ending on September 30th – up considerable from $12.1 billion reported a year earlier. Container volumes were up 0.3% year-over-year, but it’s annual volumes are up 4-6%[13]. As part of an effort to reduce delivery delays, Maersk and Hapag-Lloyd have announced plans to consolidate loads onto larger ships and to also make fewer stops at ports of call. This plan is set to roll out through their “Gemini” partnership next February. Currently the two shippers provide 55% on-time delivery rates. Their stated goal is to get that number up to 90% through this program[14]. The move to 20,000 container ships will not only provide economies of scale in the sea, but it should also allow for some domestic freight efficiencies.

With the start of the Q4 shopping season, inventories appear to be turning over more quickly, leading to the slow expansion of Warehousing Capacity (-0.1) at 55.8. Continued evidence of moderation in the warehousing industry is seen in reports that developers have pulled back on construction. There was 309 million square feet of warehousing under construction in Q3, which is down 43% year-over-year[15]. This pullback is reflected in the continued growth that we have seen in available Warehousing Capacity over the last year. During the inventory crunch of 2022 facilities could not be built quickly enough, and warehousing under construction averaged nearly 700 million square feet. I today’s more JIT-oriented environment, that level of building is no longer needed. Although it should be acknowledged that the amount of warehousing going up now is similar to what was being built in late 2019, which is likely the last time JIT methods were as prolific as they are today. It will be interesting to see if construction increases after interest rates have fallen a few more points, which would make the loans required for large-scale projects more affordable for builders. While Prologis reported increased earnings and revenue in its most recent fiscal quarter, it did warn shareholders that construction may slowdown moving forward in an effort to keep supply at an optimal level. Cushman & Wakefield report that industrial real estate vacancy was up to 6.4% in Q3 – a marked change from the 4.6% vacancy at this time a year ago and the highest level since 2014[16].

In spite of this, Warehousing Utilization is up (+1.9) to 62.9, suggesting that firms are attempting to achieve efficiencies by utilizing as much of their storage as possible. This is necessary because even with some softness in capacity, Warehousing Prices continue to expand (-1.1) at a robust rate of 65.8. Retailers are going about this pursuit of cost savings and efficiency in warehousing in multiple ways. In an effort to achieve $400 million in cost savings, retailer Home Depot is looking to shrink its warehousing portfolio, considering subleasing four buildings one million square foot buildings with a plan to put approximately 4.7 million square feet of real estate on the market[17]. Some savings will continue to come from increasing automation. Amazon’s new model of fulfillment centers will reportedly use 10 times as many robots as previous designs[18]. In other efforts to develop efficiencies in storage, Amazon is experimenting with automated “micro fulfillment centers” attached as appendages to Whole Foods grocery stores, allowing consumers to order groceries and general Amazon items at the same time for pickup[19].

Meanwhile, transportation metrics continue their recent expansionary trend, providing further evidence that the freight market is turning the corner. Transportation Prices were the big mover in October, with the rate of expansion increasing (+5.7) to 64.1 which is their most robust rate of growth since September 2022 over two years ago. These increases come even as fuel costs continue dropping. Diesel fuel prices in the U.S. were up $0.02 per gallon in the last week of October. However, there were down from earlier in the month and down significantly – approximately 88 cents per gallon – from this time a year ago[20]. Transportation Utilization is up as well (+2.1) to 59.7. The increase in utilization is driven significantly more by Upstream firms (62.8) than by Downstream retailers (52.8). Despite the continued turnaround, the most recent round of financial reporting from carriers demonstrates that the freight market is still not fully out of the woods. J.B. Hunt reported decreased profits and revenues in Q3. The decline was driven by slower volumes, but overall revenues came in ahead of analyst’s expectations. Intermodal revenues were unchanged for the quarter at $1.56 billion, with lower drop in per-load revenue offset by a 5% increase in volume[21]. Interestingly, CSX reported increased intermodal activity and revenue over the same period, reporting a 3% increase in volumes and earnings of $894 million in Q3 on revenues of $3.62 billion[22]. Old Dominion and Knight-Swift also reported a decline in earnings. Knight-Swift pointed to the slowdown in East Coast freight stemming for the hurricanes and port strike as one cause of this slowdown. Old Dominion reported a 4.8% decline in LTL freight as the cause behind their first decline in profits and revenues in 2024. Despite the slowdown, analysts are optimistic that the stabilization of freight markets will allow many of these large carriers to secure price increases going forward as we move back towards equilibrium and increased Downstream activity[23]. The validity of this strategy as a playbook for carriers going forward is evident in the price, and ultimately revenue, growth reported by XPO[24]. The U.S. Bank Freight Payment Index suggests that the rate of contraction for freight shipments and spending slowed in Q3, signaling a continued turnaround in the freight market[25].

All of this suggests that the market is turning, just more slowly than carriers would prefer. The reason for this slower turn is that there is more excess capacity in the system than we would normally have. In our previous freight inversions, we have seen available Transportation Capacity begin to contract. That has still not happened during this turnaround. Transportation Capacity has gone down to 50.0 and no movement twice (in July and September) but it has not moved towards contraction. Capacity was slightly up in October (+0.8) to 50.8, which is a very slow rate of expansion but still expansion. The reason this continues to happen is that a significant amount of freight capacity has been sitting idle for the last few years are smaller carriers and owner-operators waited out the freight recession 0f 2022-2024. Now that prices are increasing, more capacity is being enticed back to the market, making this a softer turnaround than the shock-driven freight booms we saw in 2018 (tax cut) and 2020 (COVID lockdowns). The excess capacity is making the recovery slower than some would prefer. But, as we see from future predictions, its slow and steady nature may make the recovery more sustainable.

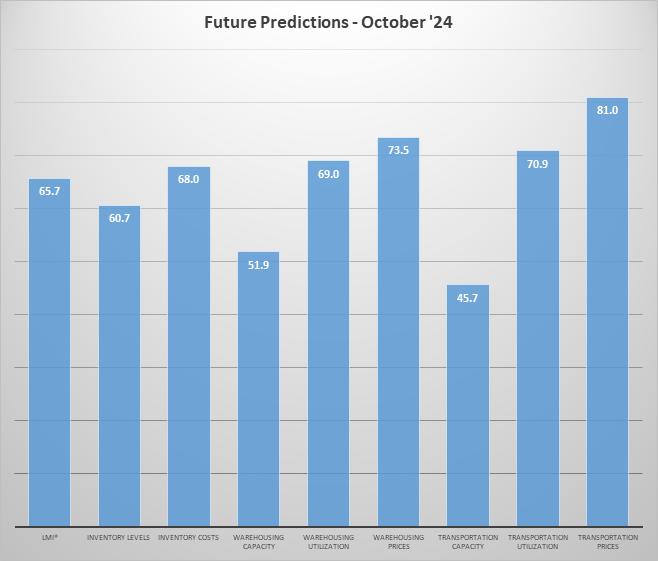

Respondents were asked to predict movement in the overall LMI and individual metrics 12 months from now. Respondents grew increasingly optimistic in October, predicting expansion in the overall index at a rate of 65.7, up slightly (+0.3) from September’s future prediction and slightly above the all-time average of 61.8. This growth is predicted to be driven by Inventory Levels expanding at a rate of 60.7. This robust rate of Inventory Level growth is predicted to cascade outwards, driving forecasted Inventory Costs (68.0), Warehousing Prices (73.5), and Transportation Prices (81.0) up to significant levels of growth. The reading of 81.0 for Transportation Prices would be the highest since early 2022 and signal a move back to a full-fledged freight boom – something that is backed up by the predicted contraction of 45.4 Transportation Capacity.

A comparison of the feedback from Upstream (blue bars) and Downstream (orange bars) respondents suggest that activity has leveled out across supply chains. Throughout most of the summer, Upstream firms reported expanding Inventory Levels while Downstream respondents reported contraction. That trend finally broke in September, as Downstream firms reported expansion in Inventory Levels at 56.7 to Upstream’s 61.0. That dynamic inverted in October with Downstream Inventory Levels now growth faster than Upstream (65.7 to 56.3) for the first time since March. Despite this flip, both sides are still building up inventories and are seeing very similar increases across all three cost/price metrics. The only statistically significant difference we find is that Upstream rates of Transportation Utilization expanded more quickly (62.8 to 52.8) than Downstream. Even with this marginal difference, this is one of the most Upstream/Downstream comparisons we have seen in 2024, suggesting that the lopsided activity we observed through most of the year has given way to a more balanced logistics industry at the start of Q4 and the holiday shopping season.

| Inv. Lev. | Inv. Costs | WH Cap. | WH Util. | WH Price | Trans Cap | Trans Util. | Trans Price | LMI | |||||||||||

| Upstream | 56.3 | 66.4 | 55.7 | 62.7 | 65.9 | 50.6 | 62.8 | 63.0 | 59.5 | ||||||||||

| Downstream | 65.7 | 64.7 | 56.1 | 63.2 | 65.6 | 51.4 | 52.8 | 66.7 | 57.9 | ||||||||||

| Delta | 9.4 | 1.7 | 0.3 | 0.6 | 0.3 | 0.8 | 10.0 | 3.7 | 1.6 | ||||||||||

| Significant? | No | No | No | No | No | No | Marginal | No | No |

Logistics activity may be somewhat uniform now, but that we see in our future predictions from Upstream (green bars) and Downstream respondents (purple bars) that may not be the case over the next 12 months. The most notable difference is in Warehousing Prices, which Upstream firms project to increase at a very robust rate of 78.0 to Downstream’s (still strong) prediction of 64.7. The increase price is tied to Upstream firms anticipating mild contraction in available Warehousing Capacity (49.3) while Downstream firms anticipate moderate expansion (57.4). We see something similar with transportation, with Upstream firms anticipating contraction (43.8) and their Downstream counterparts expecting no change (50.0). All of this stems from Upstream firms predicting a faster rate of expansion in Inventory Levels (63.2) relative to more moderate, and possibly JIT-influenced, expectations of expansion Downstream (55.6). Unsurprisingly, these differences lead to a statistically significantly greater expectation of expansion in the overall index (68.6 to 61.2). These growth rates would put Downstream firms almost right at, and Upstream firms within standard deviation, of the all-time average of 61.8. If these predictions hold, it would indicate strong, but also steady and sustainable, growth in the logistics industry in 2025.

| Futures | Inv. Lev. | Inv. Costs | WH Cap. | WH Util. | WH Price | Trans Cap. | Trans Util. | Trans Price | LMI |

| Upstream | 63.2 | 69.4 | 49.3 | 67.9 | 78.0 | 43.8 | 73.5 | 82.3 | 68.6 |

| Downstream | 55.6 | 65.3 | 57.4 | 71.4 | 64.7 | 50.0 | 65.3 | 78.4 | 61.2 |

| Delta | 7.6 | 4.1 | 8.1 | 3.6 | 13.3 | 6.3 | 8.2 | 3.9 | 7.4 |

| Significant? | No | No | No | No | Yes | No | No | No | Yes |

Harking back to the intra-month differences we observed earlier in the year, we see a few sources of difference in respondent feedback between early (gold bars) and late (green bars) in October. We observe higher rates of growth in early October (10/1-10/15) for Inventory Levels, Inventory Costs, and Warehousing Prices. Corroborating this we see that available Transportation Capacity contracted in early October at 45.8 before moving back into expansion at 54.3 later in the month. These have all combined to push the overall index to be significantly different between early (62.4) and late (56.6) October. October has been the busiest month in the overall index for the last two years as it is often the time when retailers kick into high gear ahead of peak season. The marginally significant differences observed between late and early October suggest that this may be the case in 2024 as well.