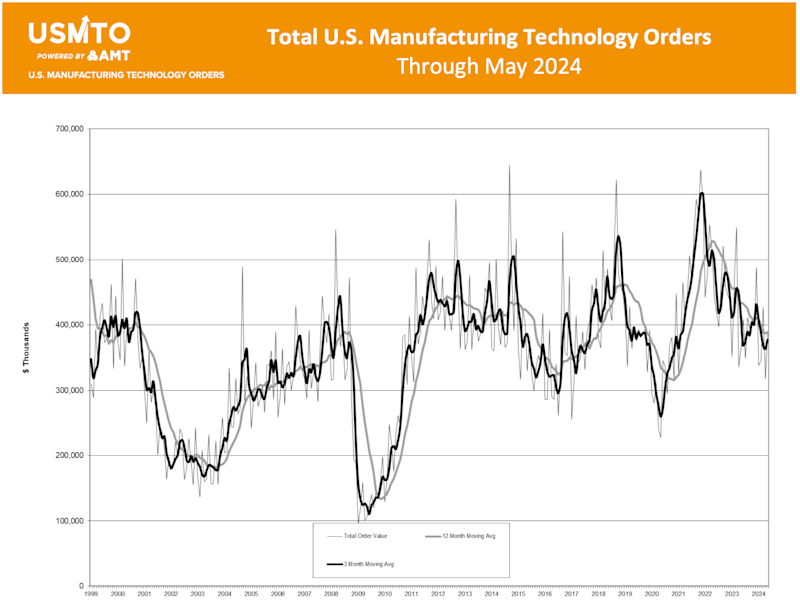

Manufacturing Technology Orders grow in May 2024 despite sustained high interest rates

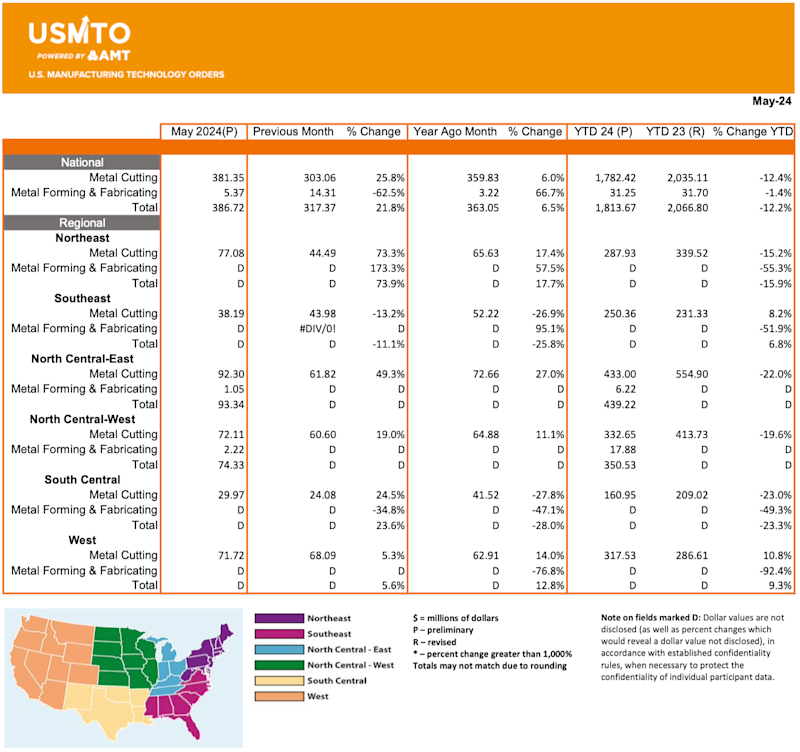

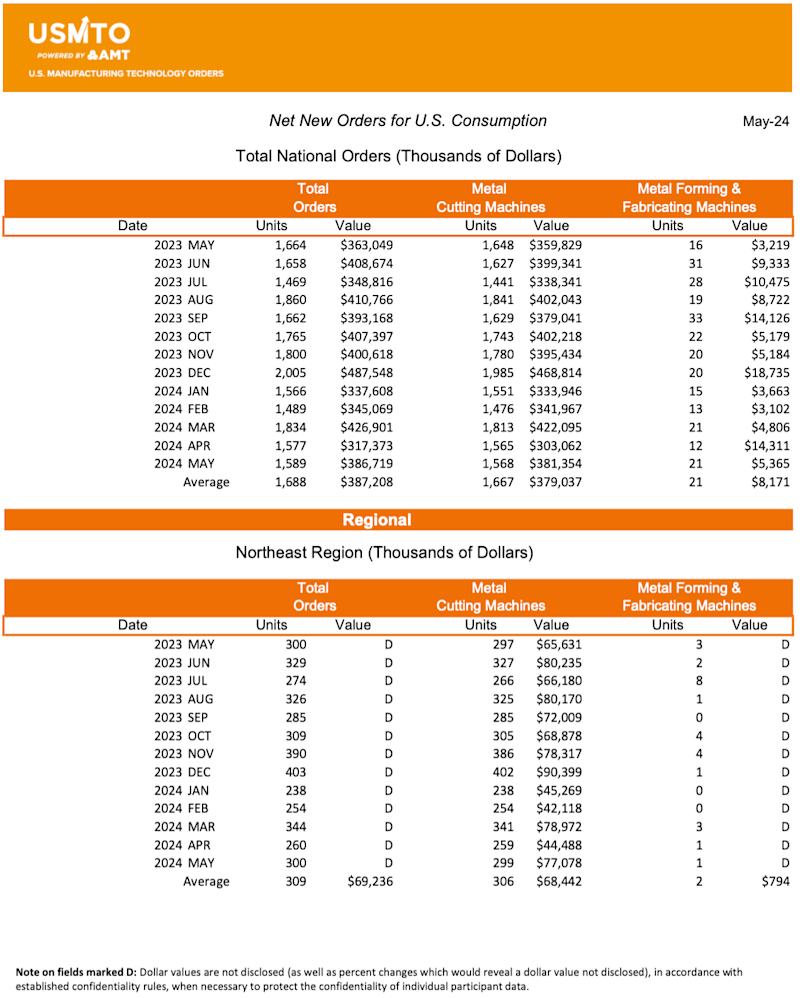

Manufacturing technology orders, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $386.7 million in May 2024. New machinery orders were up nearly 22% from April 2024 and 6.5% over May 2023. This is the first month in 2024 where the value of orders placed exceeded those of the same month the previous year. Through the first five months of 2024, orders totaled $1.8 billion, a 12.2% decrease compared to 2023.

Manufacturers have realized they can no longer outwait the Fed’s “higher for longer” interest rate strategy. As a result, they are beginning to increase capital equipment purchases to meet the sustained demand for goods and machinery from consumers and businesses, even as high interest rates persist. Despite 2024’s mild slump in machinery orders compared to the beginning of 2023, cutting tool orders, as measured by the Cutting Tool Market Report, a collaboration between AMT and the U.S. Cutting Tool Institute (USCTI), show 2024 consumption holding steady at record levels. This indicates that despite reported hesitation to invest in additional machinery, production levels remain elevated, which is confirmed by the measure of industrial production from the Federal Reserve.

- Contract machine shops, the largest consumer of manufacturing technology, increased their orders from April to May 2024 but significantly less than the industry’s overall growth. While some OEMs have made additional investments despite heightened interest rates, contract machine shops have consistently failed to keep pace with the overall market throughout 2024.

- Electrical equipment manufacturers are having the best start to the year since the record-setting start of 2022. Similarly, power generation and transmission equipment manufacturers are investing at the second-highest year-to-date rate since 2008. These industries undoubtedly benefit from the government investment authorized by the CHIPS and Infrastructure Acts and are, therefore, less sensitive to interest rates than others. As previously reported, the Biden administration is in a rush to spend the remaining money allocated by Congress under these bills in case President Joe Biden does not win reelection in November. That spending could accelerate, given the public’s response to Biden’s debate performance at the end of June.

- The automotive sector continued to purchase machinery but at a much slower pace than the previous two years. Vehicle assemblies increased in May 2024 and remained above the monthly average this year. Like manufacturers awaiting lower interest rates before investing in machinery, consumers may have grown tired of waiting out the Fed, as new vehicle sales increased in April and May.

The Fed’s interest rate path has thrown a wrench in many economic forecasts since the beginning of the year. The outlook for manufacturing technology orders was no different. The beginning of the year fell well short of expectations, but the lag behind 2023 has narrowed in recent months. Whatever course the Federal Reserve eventually takes with interest rates, the USMTO data shows the appetite for additional manufacturing capacity growing as we approach September’s IMTS 2024 – The International Manufacturing Technology Show, the largest manufacturing trade show in the Western Hemisphere.